Fillable Bill of Sale Document for Wisconsin

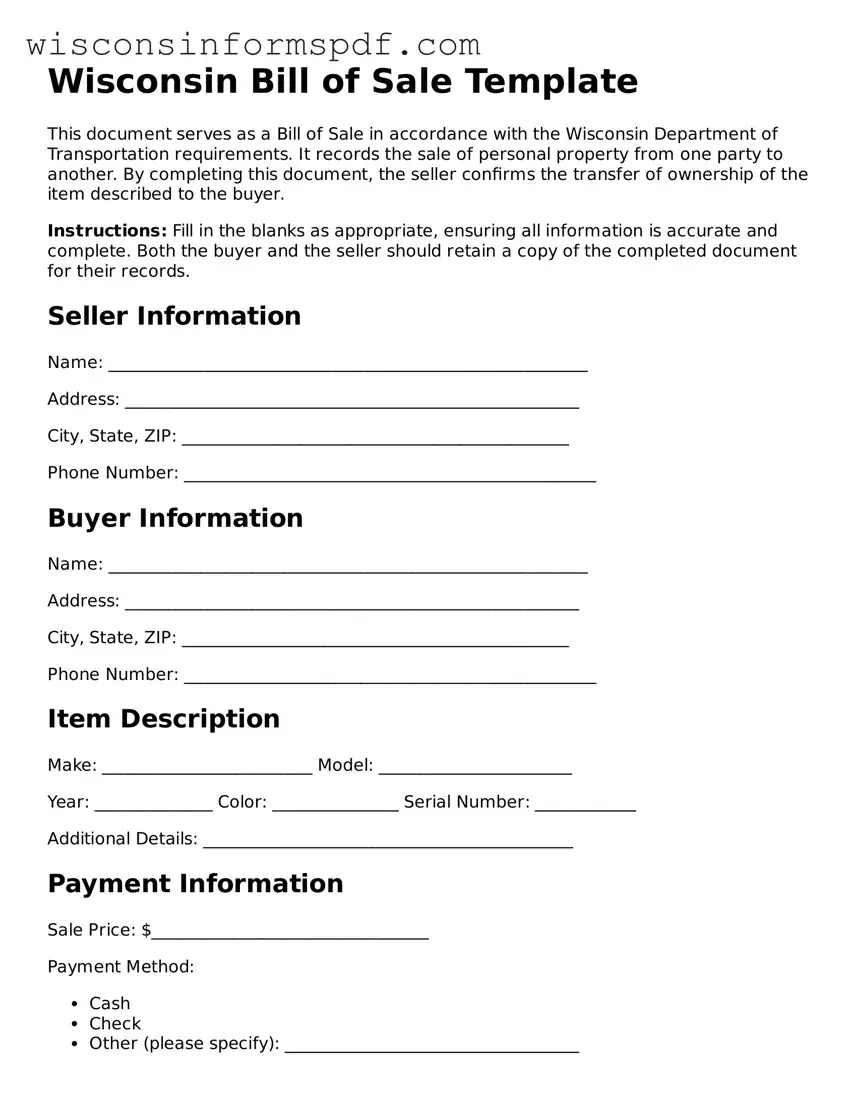

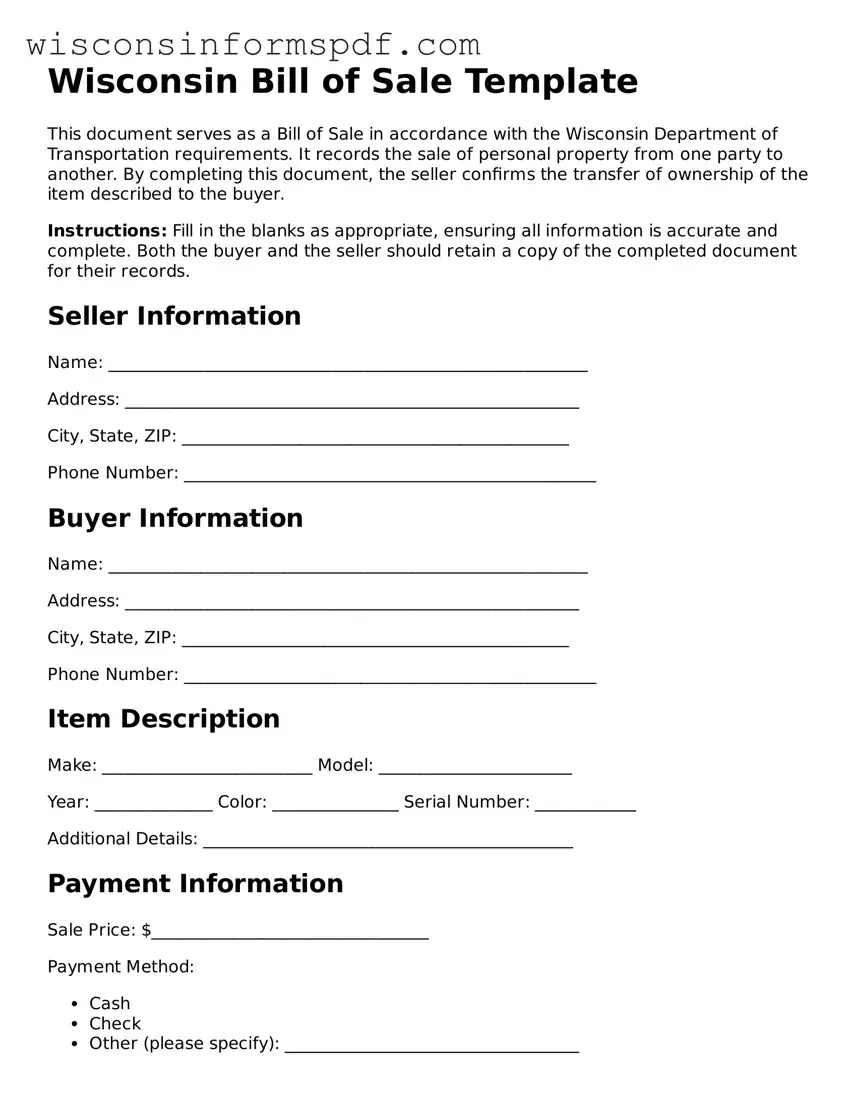

A Wisconsin Bill of Sale form is a legal document that records the transfer of a variety of items from a seller to a buyer. It serves as proof of purchase and details the transaction, including the date, price, and description of the items sold. This document is essential for both the buyer and seller, as it verifies the change in ownership and can be used for registration and tax purposes.

Create My Form

Fillable Bill of Sale Document for Wisconsin

Create My Form

Create My Form

or

Click for Bill of Sale

Want to finish this form ASAP?

Edit Bill of Sale online without printing or scanning.