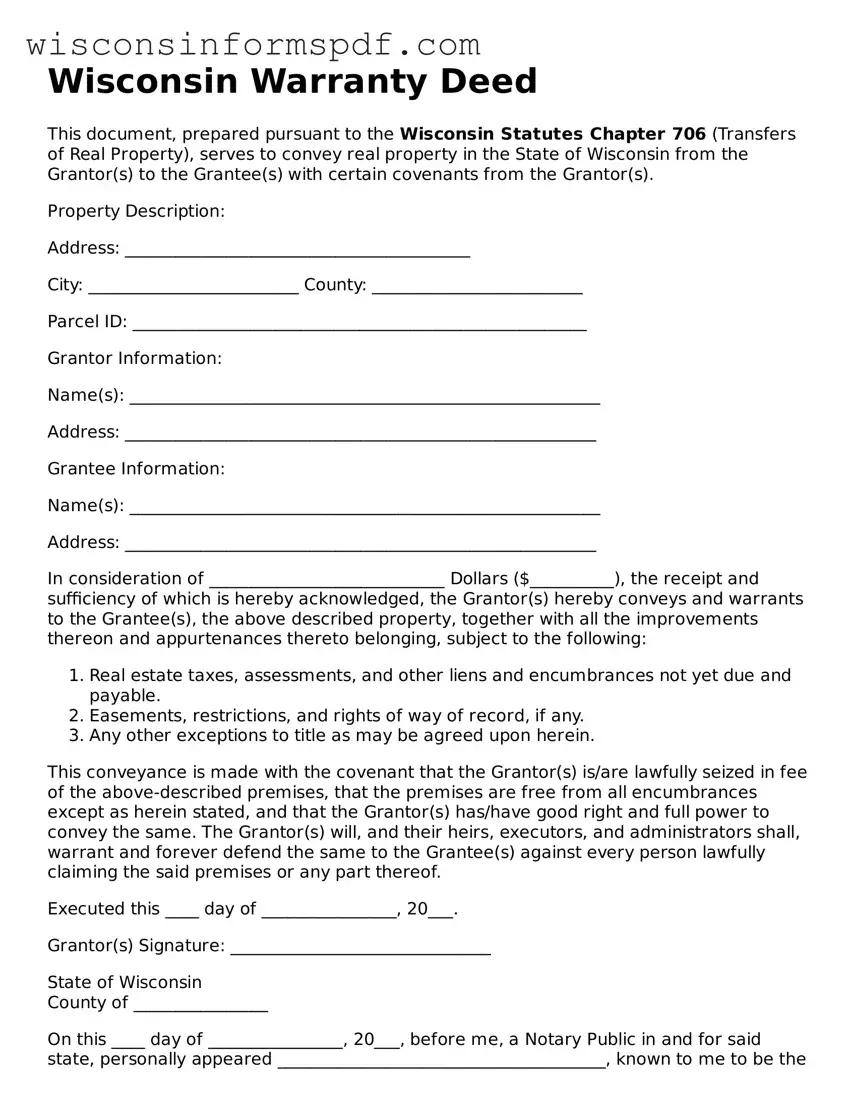

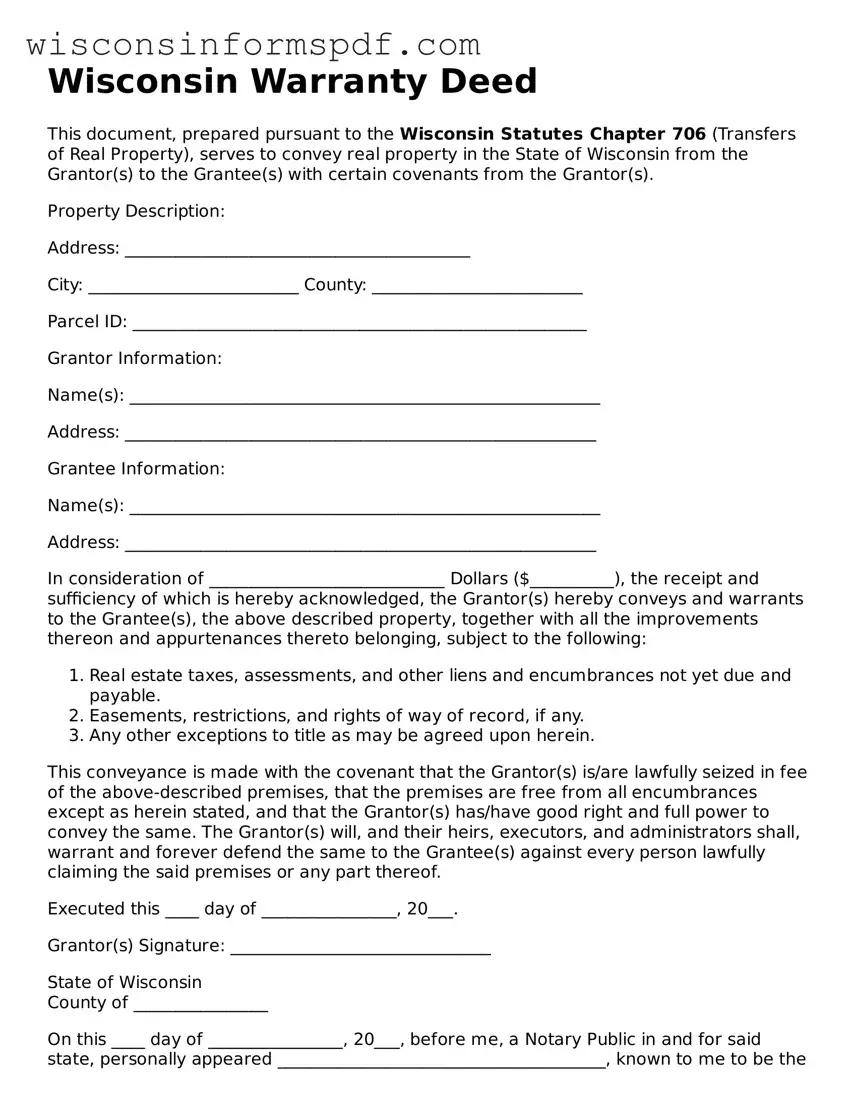

Wisconsin Warranty Deed

This document, prepared pursuant to the Wisconsin Statutes Chapter 706 (Transfers of Real Property), serves to convey real property in the State of Wisconsin from the Grantor(s) to the Grantee(s) with certain covenants from the Grantor(s).

Property Description:

Address: _________________________________________

City: _________________________ County: _________________________

Parcel ID: ______________________________________________________

Grantor Information:

Name(s): ________________________________________________________

Address: ________________________________________________________

Grantee Information:

Name(s): ________________________________________________________

Address: ________________________________________________________

In consideration of ____________________________ Dollars ($__________), the receipt and sufficiency of which is hereby acknowledged, the Grantor(s) hereby conveys and warrants to the Grantee(s), the above described property, together with all the improvements thereon and appurtenances thereto belonging, subject to the following:

- Real estate taxes, assessments, and other liens and encumbrances not yet due and payable.

- Easements, restrictions, and rights of way of record, if any.

- Any other exceptions to title as may be agreed upon herein.

This conveyance is made with the covenant that the Grantor(s) is/are lawfully seized in fee of the above-described premises, that the premises are free from all encumbrances except as herein stated, and that the Grantor(s) has/have good right and full power to convey the same. The Grantor(s) will, and their heirs, executors, and administrators shall, warrant and forever defend the same to the Grantee(s) against every person lawfully claiming the said premises or any part thereof.

Executed this ____ day of ________________, 20___.

Grantor(s) Signature: _______________________________

State of Wisconsin

County of ________________

On this ____ day of ________________, 20___, before me, a Notary Public in and for said state, personally appeared _______________________________________, known to me to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged that he/she/they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

Notary Public Signature: _________________________________

My commission expires: ____________