What is the purpose of the Wisconsin Employment Verification form?

The Wisconsin Employment Verification form serves as a critical document designed to verify the employment status of an individual within the state. Employers use this form to officially affirm an employee's work status, position, and income. This verification is often required for various purposes, including loan applications, government assistance programs, or any scenario where proof of employment and income is necessary.

Who needs to fill out the Wisconsin Employment Verification form?

The task of filling out the Wisconsin Employment Verification form typically falls on employers. When an employee requires proof of employment for any official purpose, the employer or the authorized representative of the company is responsible for completing the form with accurate details about the employee’s job title, tenure, salary, and other relevant employment information.

Where can I find the Wisconsin Employment Verification form?

Individuals can obtain the Wisconsin Employment Verification form through the official website of the Wisconsin Department of Workforce Development or by contacting the Human Resources department of their employer, who may have easy access to the latest forms and guidelines.

Is there a fee to process the Wisconsin Employment Verification form?

Typically, there is no fee charged by employers or state agencies for filling out or processing the Wisconsin Employment Verification form. However, it is advisable to confirm with the specific entity handling the form, as policies and practices may vary.

How should the form be submitted once completed?

The submission process for the Wisconsin Employment Verification form can vary depending on the requesting party's requirements. Generally, it may be submitted electronically via email, through postal mail, or in person. Employers should ensure they follow the instructions provided by the entity requesting the verification to ensure proper and timely processing.

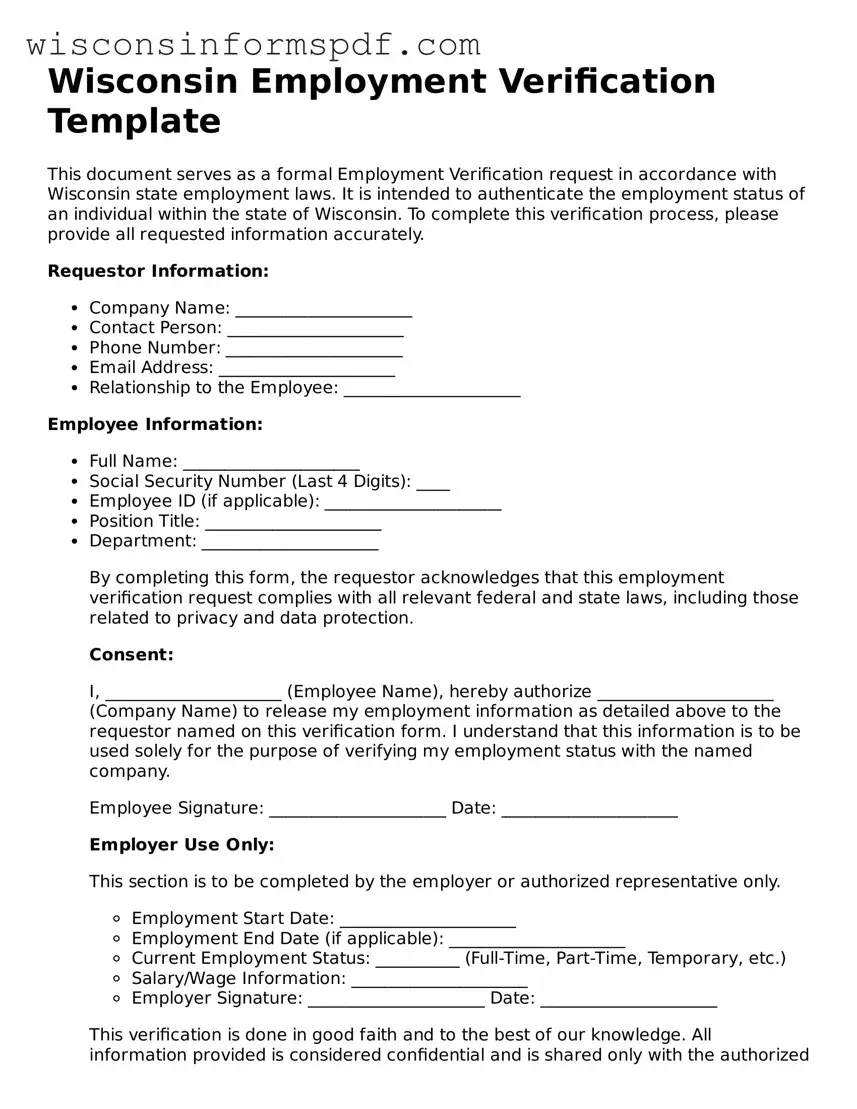

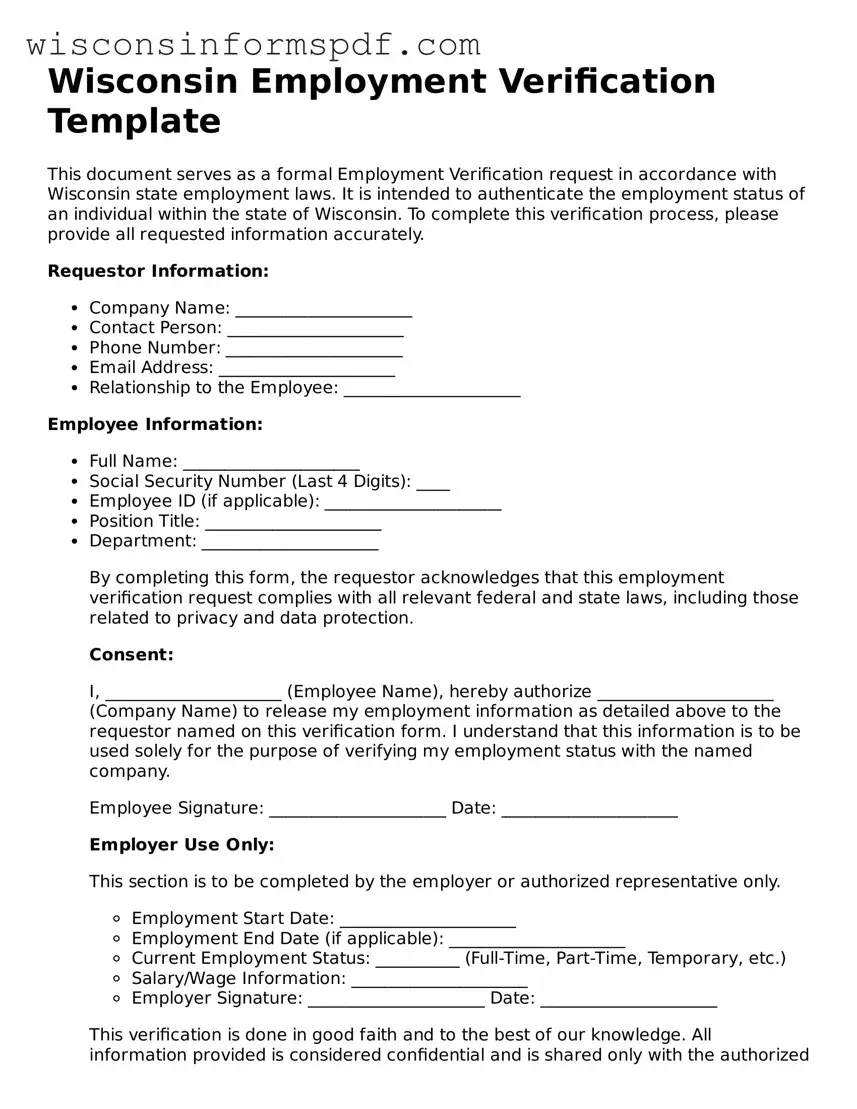

What information is required on the form?

The form typically requires detailed employment information such as the employee's full name, social security number or employee identification number, job title, period of employment, salary details, and employer’s contact information. It may also ask for the employer's confirmation regarding the employee’s current employment status and likelihood of continued employment.

How do I ensure the accuracy of the information provided?

Ensuring the accuracy of the information on the Wisconsin Employment Verification form is crucial. Employers should cross-reference the employee’s details with company records. Employees should provide any required documents or information to the employer to aid in this process. Careful review before submission can prevent delays or issues arising from inaccuracies.

Can the form be rejected, and what should I do if it is?

Yes, the form can be rejected if it is incomplete, contains inaccuracies, or fails to meet the requesting party's requirements. Should rejection occur, it is important to carefully review the reasons provided, correct any errors or provide any missing information, and resubmit the form as instructed. Communication with the requesting entity to clarify requirements can also be helpful in ensuring acceptance on a subsequent submission.