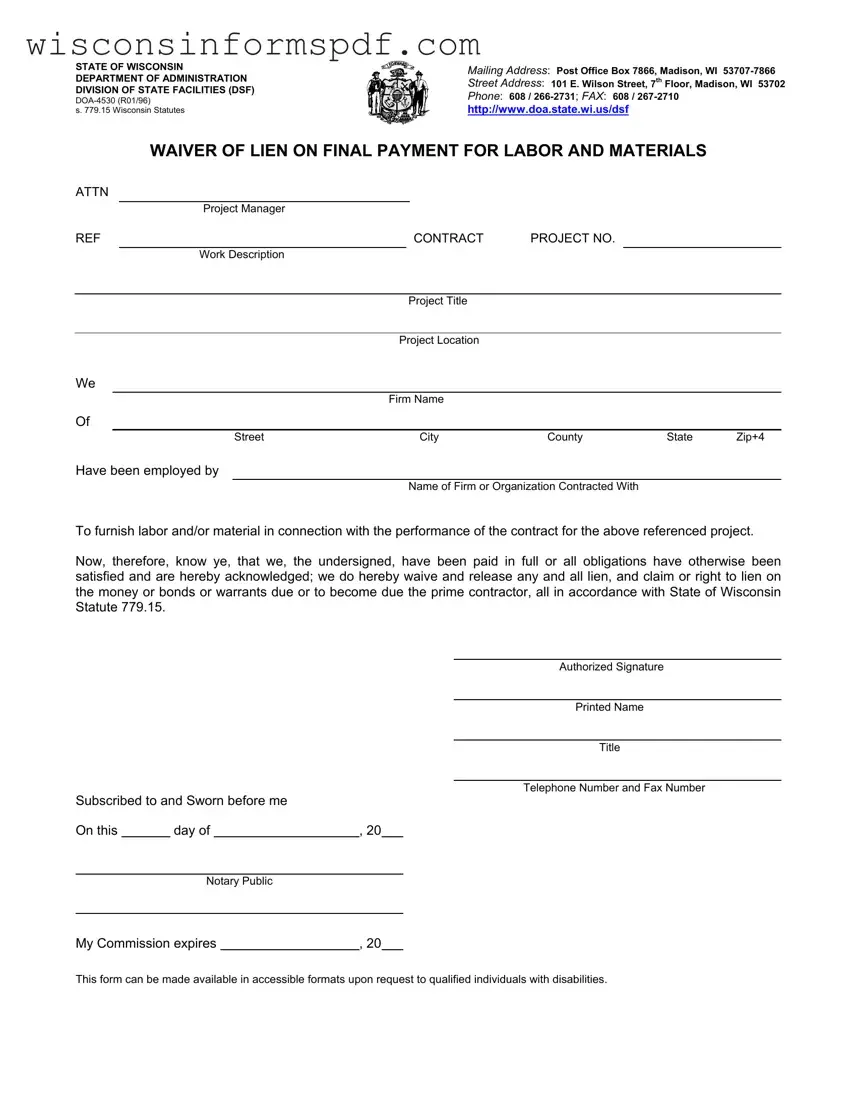

What is a Lien Waiver in Wisconsin?

A lien waiver in Wisconsin is a legal document in which a contractor, subcontractor, supplier, or other party to a construction project agrees to waive their right to file a lien against a property for the amount of labor or materials supplied. This waiver is typically requested by the payer to ensure that no lien will be filed once payments have been made, securing a clear title for the property owner.

Who needs to use a Lien Waiver in Wisconsin?

Any party who has provided labor, materials, or any type of service that enhances the value of real property may need to use a lien waiver in Wisconsin. This can include contractors, subcontractors, laborers, and suppliers. Property owners or general contractors may also require these parties to submit a lien waiver to confirm that they have received payment and waive their right to file a lien.

When should a Lien Waiver be submitted in Wisconsin?

A Lien Waiver should be submitted in Wisconsin once a party has received full payment for their services or materials supplied to a construction project. It is typically submitted before the final payment is released to ensure that the property is free of any potential liens.

What does the Lien Waiver on Final Payment for Labor and Materials cover?

The Lien Waiver on Final Payment for Labor and Materials in Wisconsin covers the full and final release of any claim or right to file a lien by the party providing labor, materials, or services. It acknowledges that the signer has been paid in full and waives any future liens against the property related to the contract.

Is a notary required for a Lien Waiver in Wisconsin?

Yes, a notary is required for a Lien Waiver in Wisconsin. The document must be signed by the party waiving their right to a lien in the presence of a notary public. The notary public then validates the signer's identity and the authenticity of the signature, adding an extra layer of legal protection.

What statute governs Lien Waivers in Wisconsin?

Lien Waivers in Wisconsin are governed by State of Wisconsin Statute 779.15. This statute outlines the legal framework for the use and enforcement of lien waivers in the state, ensuring that all parties to a construction project understand their rights and obligations regarding liens and lien waivers.

What happens if I don’t submit a Lien Waiver in Wisconsin?

If a party does not submit a Lien Waiver in Wisconsin upon receiving payment, they retain the right to file a lien against the property. This can lead to legal complications for the property owner, including the potential to sell or refinance the property. Submitting a lien waiver provides peace of mind for all parties involved by guaranteeing that the property is free from claims related to labor, services, or materials supplied.