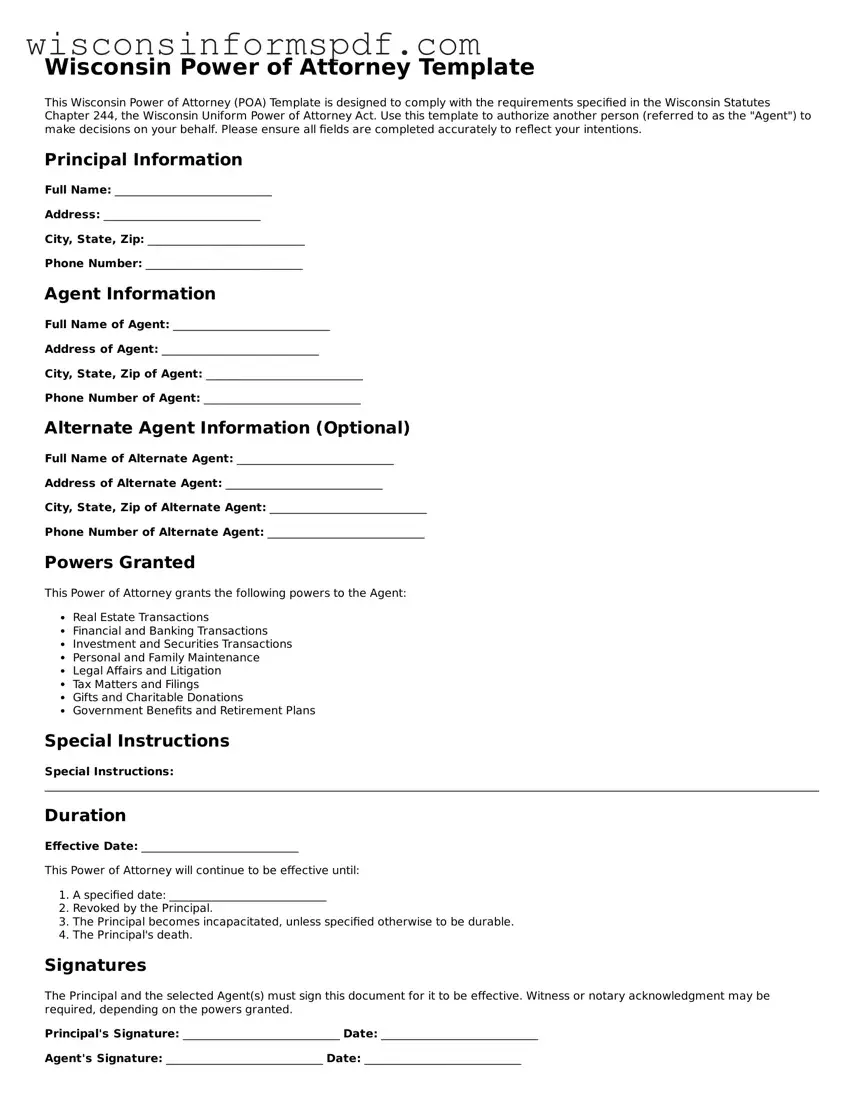

Wisconsin Power of Attorney Template

This Wisconsin Power of Attorney (POA) Template is designed to comply with the requirements specified in the Wisconsin Statutes Chapter 244, the Wisconsin Uniform Power of Attorney Act. Use this template to authorize another person (referred to as the "Agent") to make decisions on your behalf. Please ensure all fields are completed accurately to reflect your intentions.

Principal Information

Full Name: ____________________________

Address: ____________________________

City, State, Zip: ____________________________

Phone Number: ____________________________

Agent Information

Full Name of Agent: ____________________________

Address of Agent: ____________________________

City, State, Zip of Agent: ____________________________

Phone Number of Agent: ____________________________

Alternate Agent Information (Optional)

Full Name of Alternate Agent: ____________________________

Address of Alternate Agent: ____________________________

City, State, Zip of Alternate Agent: ____________________________

Phone Number of Alternate Agent: ____________________________

Powers Granted

This Power of Attorney grants the following powers to the Agent:

- Real Estate Transactions

- Financial and Banking Transactions

- Investment and Securities Transactions

- Personal and Family Maintenance

- Legal Affairs and Litigation

- Tax Matters and Filings

- Gifts and Charitable Donations

- Government Benefits and Retirement Plans

Special Instructions

Special Instructions: __________________________________________________________________________________________________________________________________________________________________________________

Duration

Effective Date: ____________________________

This Power of Attorney will continue to be effective until:

- A specified date: ____________________________

- Revoked by the Principal.

- The Principal becomes incapacitated, unless specified otherwise to be durable.

- The Principal's death.

Signatures

The Principal and the selected Agent(s) must sign this document for it to be effective. Witness or notary acknowledgment may be required, depending on the powers granted.

Principal's Signature: ____________________________ Date: ____________________________

Agent's Signature: ____________________________ Date: ____________________________

Alternate Agent's Signature (if applicable): ____________________________ Date: ____________________________