What is a Wisconsin Promissory Note?

A Wisconsin Promissory Note is a legal document that outlines a loan agreement between two parties in Wisconsin. It records the amount borrowed, the interest rate, repayment schedule, and other terms of the agreement, making the borrower legally obliged to repay the specified sum under those conditions.

Is a Wisconsin Promissory Note legally binding?

Yes, a Wisconsin Promissory Note is legally binding when it is properly filled out and signed by both the lender and the borrower. It can serve as evidence in court if there is a dispute over the repayment of the loan.

Do I need a witness or notary for a Promissory Note in Wisconsin?

In Wisconsin, having a witness or notarizing a Promissory Note is not usually required for it to be considered valid. However, involving a notary can add a layer of verification and could protect both parties in case of disagreements.

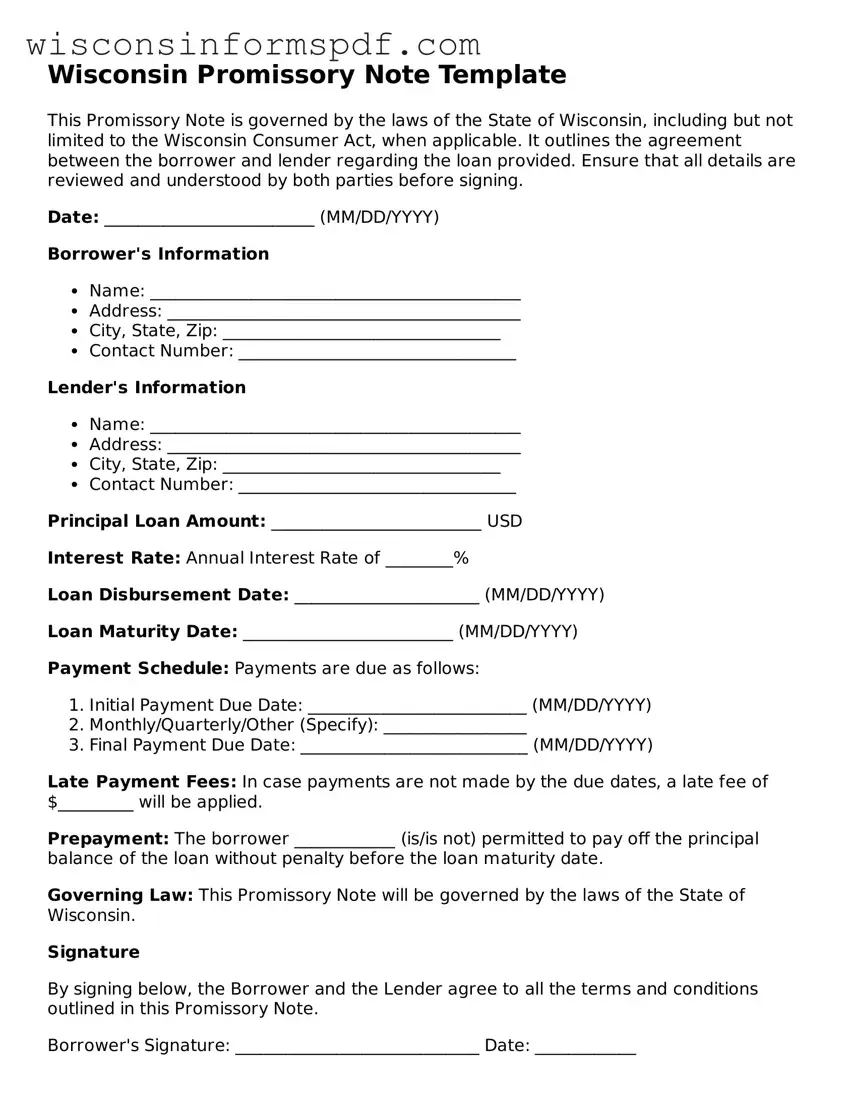

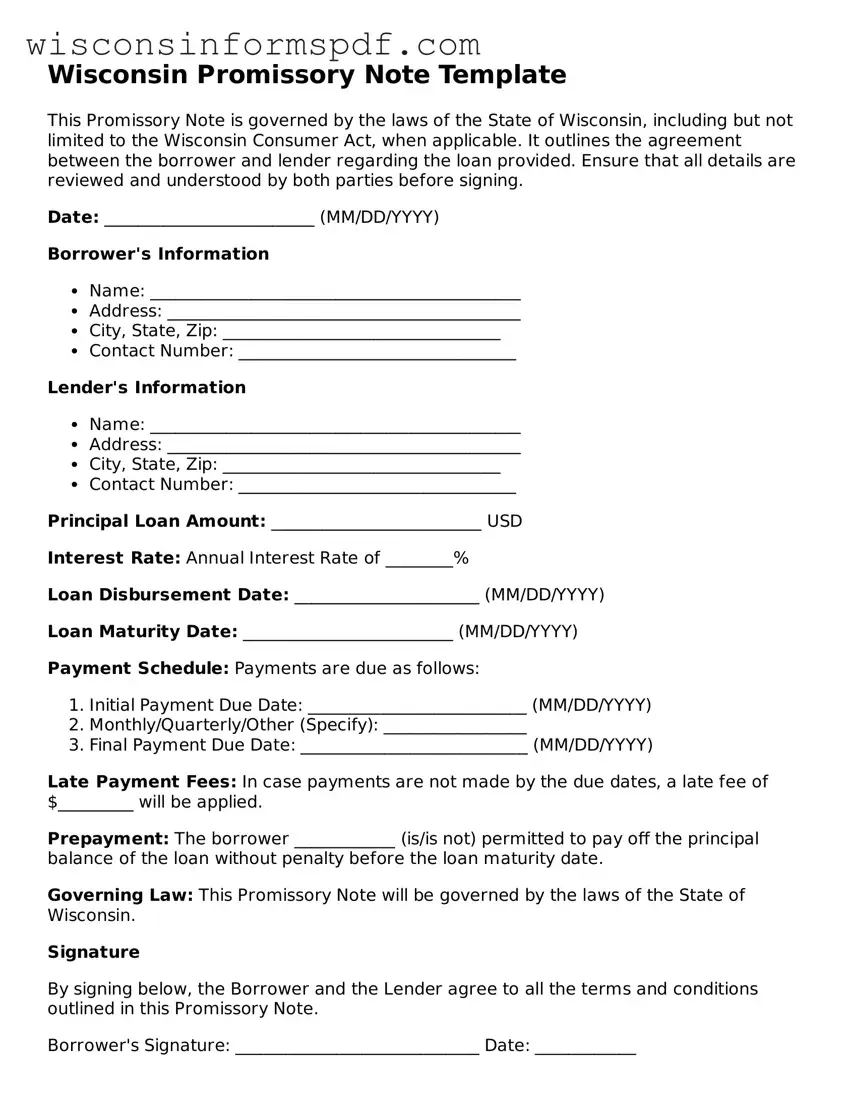

What information should be included in a Wisconsin Promissory Note?

The form should specify the amount of money lent, the interest rate, payment schedule, parties' information (lender and borrower), and any collateral if the note is secured. It may also include what happens if the borrower fails to make payments on time.

Can the interest rate on a Wisconsin Promissory Note be any amount?

No, the interest rate must comply with Wisconsin's usury laws, which cap the maximum interest rate to prevent unfair lending practices. Before setting the interest rate, it's important to check the current limits under state law.

What is the difference between a secured and an unsecured Promissory Note?

A secured Promissory Note requires the borrower to pledge an asset as collateral for the loan, offering the lender protection if the borrower fails to repay. An unsecured note does not involve collateral, posing a higher risk to the lender.

How can a lender enforce a Wisconsin Promissory Note if the borrower fails to pay?

If a borrower fails to make payments as agreed, the lender has the right to file a lawsuit to collect the debt. In the case of a secured note, the lender may also obtain the collateral. It's encouraged to seek legal advice to navigate the collection process properly.

Can the terms of a Wisconsin Promissory Note be modified after it's signed?

Yes, the terms can be modified, but any changes should be made in writing, and both the lender and the borrower must agree to the modifications. The amended agreement should then be signed by both parties.

What happens if I lose my original Wisconsin Promissory Note?

If the original note is lost, parties should create a signed statement detailing the note’s loss and the agreement's terms. This can serve as a substitute for the original note. It's also a good idea to include the steps taken to search for the lost document and any details of its presumed loss.