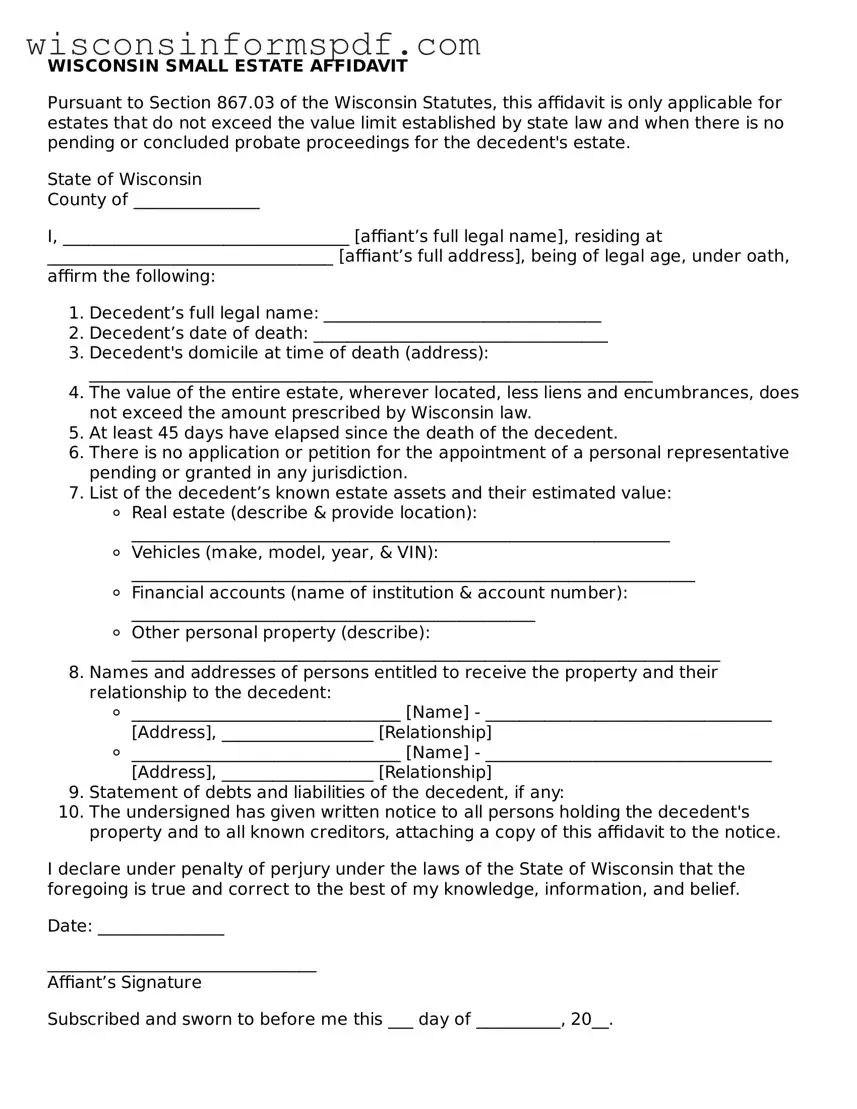

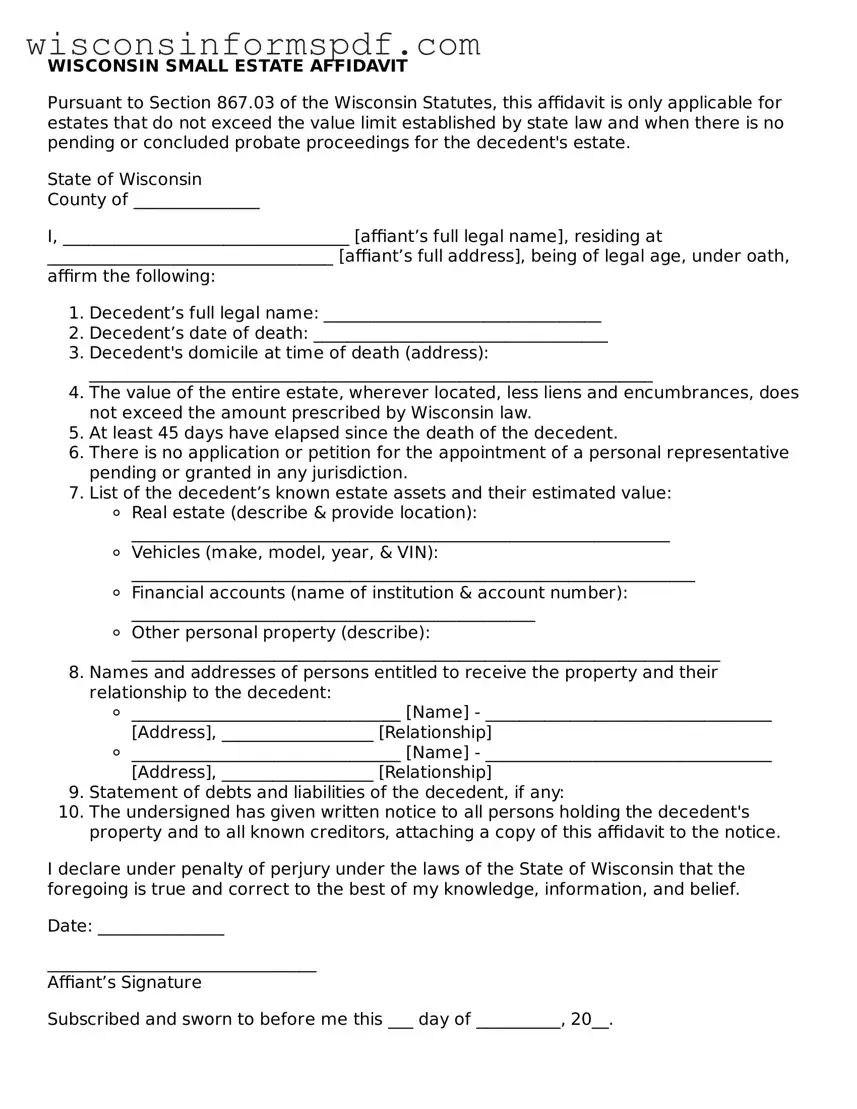

Fillable Small Estate Affidavit Document for Wisconsin

The Wisconsin Small Estate Affidavit form is a legal document used by heirs or designated representatives to manage and distribute a deceased person's property without undergoing the formal probate process. This form becomes applicable when the total value of the estate falls below a threshold set by Wisconsin law, simplifying the distribution of assets. Its use is contingent upon meeting specific criteria, emphasizing the need for careful assessment prior to application.

Create My Form

Fillable Small Estate Affidavit Document for Wisconsin

Create My Form

Create My Form

or

Click for Small Estate Affidavit

Want to finish this form ASAP?

Edit Small Estate Affidavit online without printing or scanning.