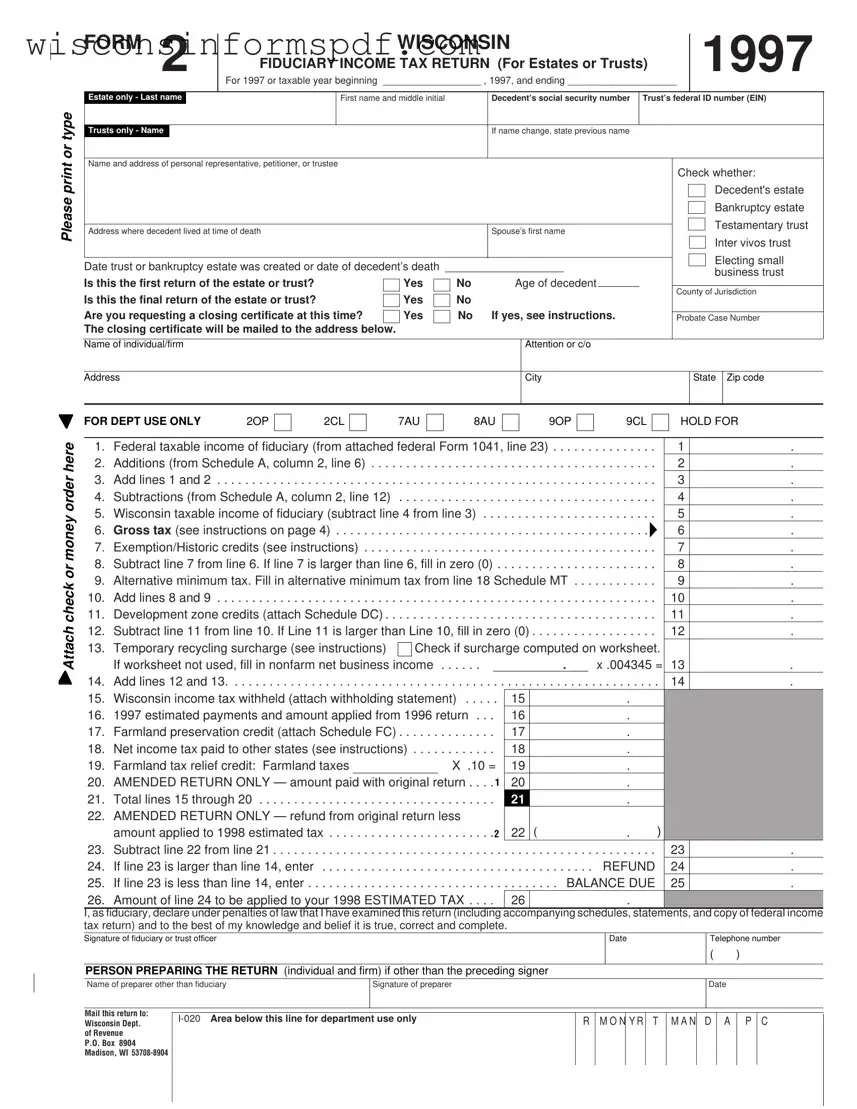

What is the Wisconsin Form 2 used for?

Wisconsin Form 2 is used by estates or trusts to file their fiduciary income tax return. It's for reporting income, deductions, and credits of the estate or trust for the tax year. This form is necessary for managing the tax obligations related to income the estate or trust generates.

Who needs to file the Wisconsin Form 2?

Any estate or trust with income generated in Wisconsin is required to file Form 2. This includes estates of deceased individuals, trusts established by a will (testamentary trusts), living trusts (inter vivos trusts), and certain bankruptcy estates. If you're a personal representative, trustee, or petitioner managing such entities, you'll likely need to complete this form.

Is there a deadline for filing Form 2 in Wisconsin?

Yes, the Wisconsin Form 2 typically must be filed by April 15 of the year following the tax year being reported. If the estate or trust operates on a fiscal year rather than a calendar year, the filing deadline is the 15th day of the fourth month after the close of the fiscal year.

Can I request a closing certificate using Form 2?

Yes, you can request a closing certificate for fiduciaries by indicating "Yes" on the form where asked if you are requesting a closing certificate at this time. This certificate is important as it officially closes the estate or trust with the Wisconsin Department of Revenue.

What information do I need to complete Form 2?

You'll need the estate's or trust's federal ID number (EIN), the decedent's Social Security number for estates, details about income and deductions reported to the IRS, and any specific state adjustments. Additionally, information about the personal representative, petitioner, or trustee is required alongside any schedules or additional forms that support your tax return.

What are the key parts of Form 2?

Key sections include reporting federal taxable income, making Wisconsin-specific adjustments, calculating Wisconsin taxable income, applying tax rates, and claiming any available credits. You'll also report any Wisconsin income tax withheld and make payments or refunds.

How do I calculate Wisconsin taxable income on Form 2?

Start with the federal taxable income reported on the federal Form 1041 and make adjustments as outlined in the Wisconsin Form 2 instructions. This includes additions and subtractions specific to Wisconsin law. The resulting figure is the Wisconsin taxable income for the estate or trust.

What happens if I file Form 2 late?

Filing late can result in penalties and interest charges on any unpaid tax due to the state. To avoid these, it's crucial to file on time or request an extension if you need more time to prepare an accurate return.

Can I file Form 2 electronically?

As of the latest updates, Wisconsin allows for electronic filing of Form 2 for estates and trusts. Filing electronically is faster, more secure, and can expedite the processing of your return and any refunds due.

Where do I mail my completed Wisconsin Form 2?

If you're submitting your Form 2 on paper, mail it to the Wisconsin Department of Revenue at the following address: P.O. Box 8904, Madison, WI 53708-8904. Make sure all supporting documents are attached and that the form is signed and dated correctly.