|

|

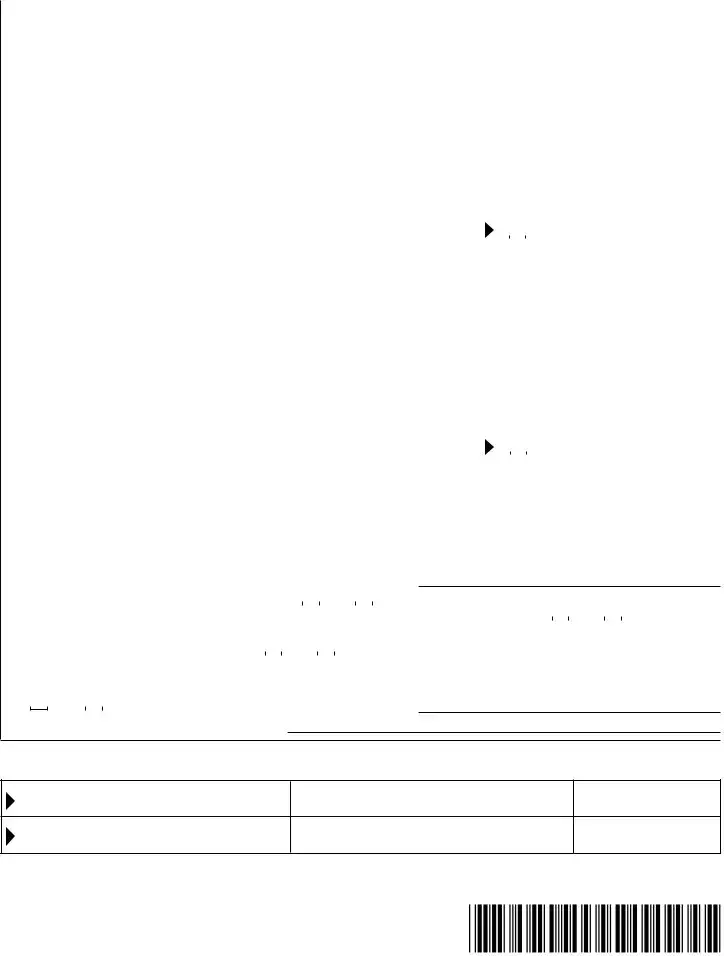

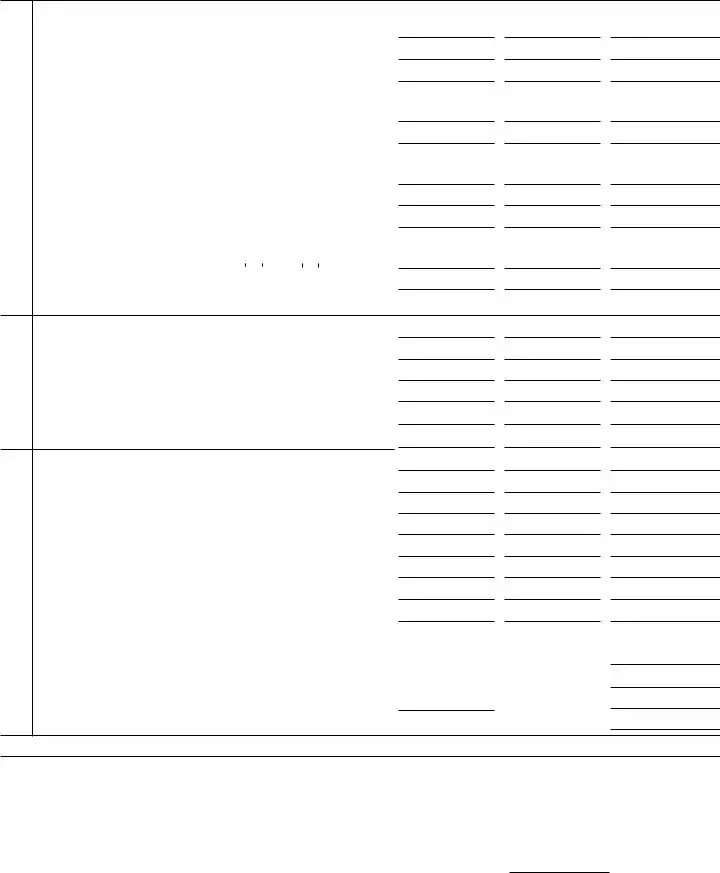

(a) Pro rata share items |

|

|

(b) Federal amount |

(c) Adjustment |

|

(d) Amount under Wis. law |

1 |

Ordinary business income (loss) |

. |

|

|

|

|

|

|

2 |

. . . . .Net rental real estate income (loss) (attach Form 8825) |

. |

|

|

|

|

|

|

3 |

. . . . . . . . . . .Other net rental income (loss) (attach schedule) |

. |

|

|

|

|

|

|

4 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Interest income |

. |

|

|

|

|

|

|

5 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Ordinary dividends |

. |

|

|

|

|

|

|

6 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Royalties |

. |

|

|

|

|

|

|

7 |

. . . . . . . . . . . . . . . . . . . . . . .Net short-term capital gain (loss) |

. |

|

|

|

|

|

|

8 |

. . . . . . . . . . . . . . . . . . . . . . . .Net long-term capital gain (loss) |

. |

|

|

|

|

|

|

9 |

. . . . . . . . . . .Net section 1231 gain (loss) (attach Form 4797) |

. |

|

|

|

|

|

|

10 |

. . . . . . . . . . . . . . . . . . .Other income (loss) (attach schedule) |

. |

|

|

|

|

|

|

11 |

. . . . . . . . . . . . . . .Section 179 deduction (attach Form 4562) |

. |

|

|

|

|

|

|

12 |

a |

. . . . . . . . . . . . . . . .Contributions |

. |

|

|

|

|

|

|

|

b |

. . . . . . . . . . . . . . . .Investment interest expense |

. |

|

|

|

|

|

|

|

c |

Section 59(e)(2) expenditures (1) Type |

|

|

|

|

|

|

|

|

|

|

|

(2) Amount |

. |

|

|

|

|

|

|

|

d |

. . . . . . . . . . . . . . . .Other deductions (attach schedule) . . . |

. |

|

|

|

|

|

|

13 |

a |

Manufacturing investment credit - from carryover at shareholder level |

|

|

|

b |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . .Manufacturing investment credit - from carryover at entity level |

|

|

c |

. . . . . . . . . . . . . .Dairy and livestock farm investment credit |

. . |

. . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

|

|

|

d |

. . .Health Insurance Risk-Sharing Plan assessments credit |

. . |

. . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

|

|

|

e |

. . . . . . . . . . . . . . . .Ethanol and biodiesel fuel pump credit. |

. . |

. . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

|

|

|

f |

. . . . . . . . . . . . . . . .Development zones credit |

. . |

. . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

|

|

|

g |

. . . . . . . . .Development opportunity zone investment credit |

. . |

. . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

|

|

|

h |

. . . . . . . . . . . .Development zone capital investment credit |

. . |

. . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

|

|

|

i |

. . . . . . . . . . . . . . . .Economic development tax credit |

. . |

. . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

|

|

|

j |

. . . . . . . . . . . . . . . .Technology zone credit |

. . |

. . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

|

|

|

k |

. . . . . . . . . . . . . . . .Early stage seed investment credit. . . . |

. . |

. . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

|

|

|

l |

. . . . .Supplement to federal historic rehabilitation tax credit |

. . |

. . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

|

|

|

. . . . . . . . . . . . . . . . . . . . . . . . . . .m Internet equipment credit |

. . |

. . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

|

|

|

n |

. . . . . . . . . . .Dairy manufacturing facility investment credit |

. . |

. . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

|

|

|

o |

. . . . . . . . . . . . . . . .Dairy cooperatives credit |

. . |

. . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

|

|

|

p |

. . . . . . . . . . . . . .Meat processing facility investment credit |

. . |

. . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

|

|

|

q |

. . . . . . . . . . . . . . . .Enterprise zone jobs credit |

. . |

. . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

|

|

|

r |

. . . . . . . . . . . . . . . .Film production services credit |

. . |

. . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

|

|

|

s |

. . . . . . . . . . . . .Film production company investment credit |

. . |

. . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

|

|

|

t |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Food processing plant and food warehouse investment credit |

|

|

u |

. . . . . . . . . . . . . . . .Jobs tax credit |

. . |

. . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

|

|

|

v |

. . . . . . . . . . . . . . . .Postsecondary education credit |

. . |

. . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

|

|

|

w |

. . . . . . . .Woody biomass harvesting and processing credit |

. . |

. . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

|

|

|

x |

. . . . . . . . . . . . . . . .Water consumption credit |

. . |

. . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

|

|

|

yy Tax paid to other states (enter postal abbreviation of state) |

(1) |

|

|

. . . . . . . . . . . . . . |

|

|

|

|

|

|

|

|

|

|

|

|

(2) |

|

|

. . . . . . . . . . . . . . |

|

|

|

|

|

|

(3) |

|

|

. . . . . . . . . . . . . . |

|

|

|

zz Wisconsin tax withheld (do not include tax properly claimed on page 1, line 15) |

. . . . . . . . . . . . . . |

|

|

14 |

a |

. . . . . . . . . . . . . . . .Name of country or U.S. possession . . |

. |

|

|

|

|

|

|

|

b |

. . . . . . . . . . . . . . . .Gross income from all sources |

. |

|

|

|

|

|

|

|

c |

. . . . . . . . . . . . .Gross income sourced at shareholder level |

. |

|

|

|

|

|

|