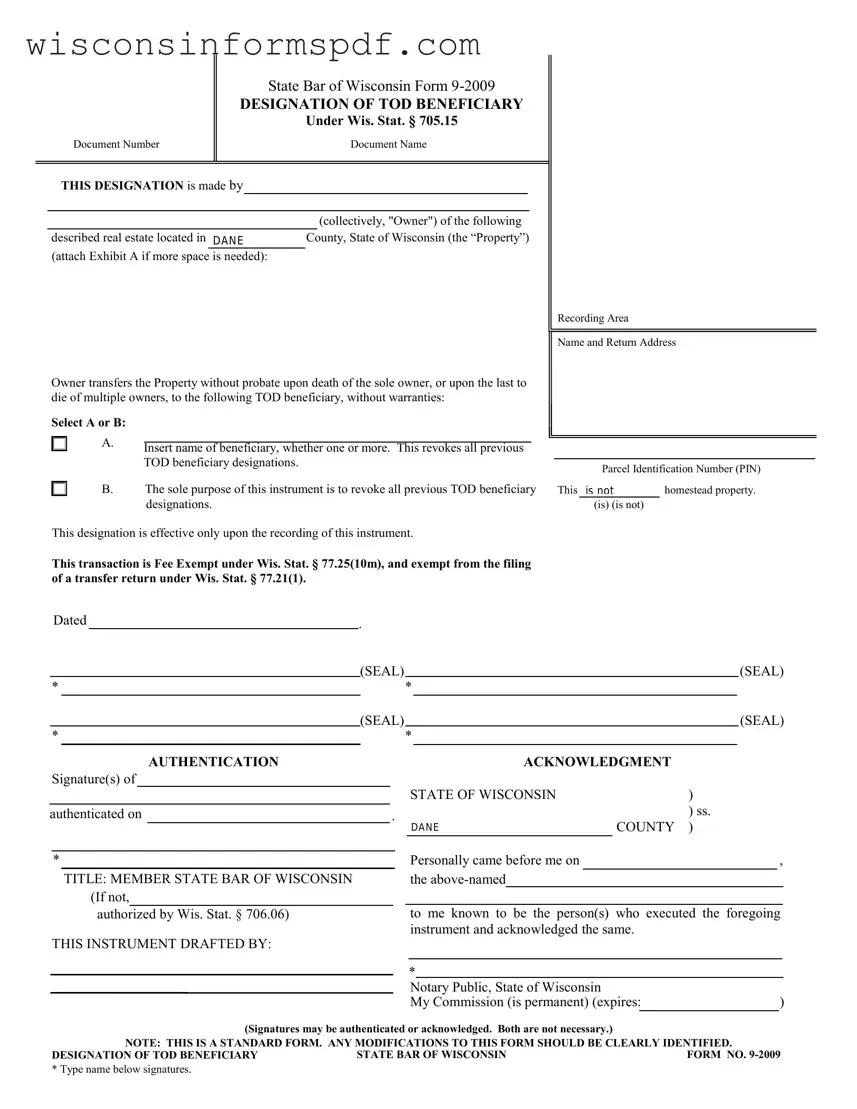

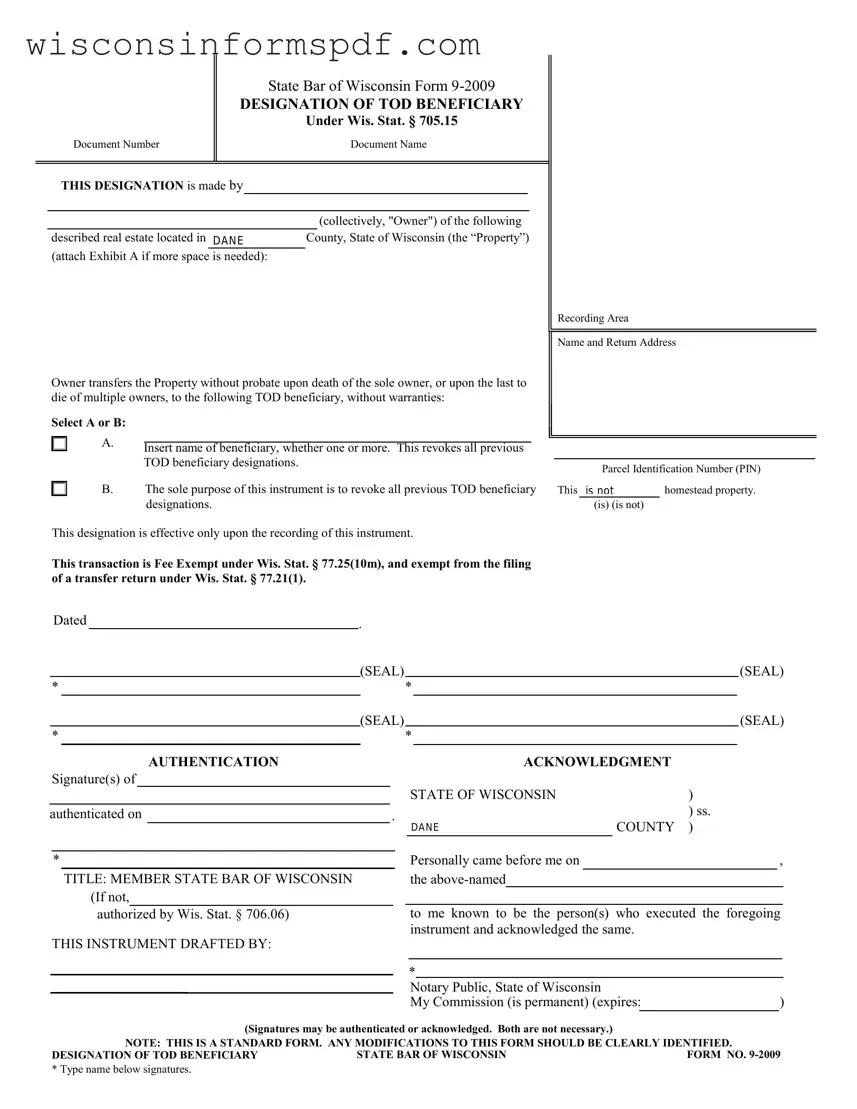

What is the Wisconsin 9 form?

The Wisconsin 9 form, officially titled "Designation of TOD Beneficiary" under Wisconsin Statute § 705.15, is a legal document used to designate a Transfer on Death (TOD) beneficiary for real estate property located in Wisconsin. This form allows the owner(s) of the property to transfer the property directly to a beneficiary upon the owner's death without the need for probate.

Why would someone use the Wisconsin 9 form?

Individuals use the Wisconsin 9 form to ensure a smooth and direct transfer of their real estate to a chosen beneficiary after their death. It helps avoid the time-consuming and often costly probate process, ensuring that the property transfers directly to the designated beneficiary, thus providing peace of mind and financial security to the beneficiary.

How do you designate a beneficiary on the Wisconsin 9 form?

To designate a beneficiary on the Wisconsin 9 form, the property owner must complete the form by inserting the name of the beneficiary (or beneficiaries, if more than one) in the designated section. This action will revoke all previous TOD beneficiary designations for the specified property. The form must be properly executed, signed, and then recorded with the appropriate county's Register of Deeds.

Can you change the TOD beneficiary after filing the Wisconsin 9 form?

Yes, the TOD beneficiary designation can be changed after the initial filing of the Wisconsin 9 form. To change the beneficiary, the property owner must complete a new Wisconsin 9 form with the updated beneficiary information and then record the new form with the county's Register of Deeds. Filing the new form revokes all previous TOD beneficiary designations.

Is there a fee associated with filing the Wisconsin 9 form?

The transaction involving the Wisconsin 9 form is fee-exempt under Wis. Stat. § 77.25(10m), and it is also exempt from the filing of a transfer return under Wis. Stat. § 77.21(1). However, the county Register of Deeds may charge a recording fee for the form. It's advisable to check with the specific county for any applicable recording fees.

Does the Wisconsin 9 form avoid probate?

Yes, using the Wisconsin 9 form effectively allows the designated real estate property to bypass the probate process for the transfer of property upon the death of the owner. The property directly transfers to the named TOD beneficiary, streamlining the inheritance process.

Can multiple beneficiaries be named on the Wisconsin 9 form?

Yes, multiple beneficiaries can be named on the Wisconsin 9 form. Property owners can specify how the real estate should be divided among the beneficiaries. It's important to clearly identify each beneficiary and their respective share to avoid any confusion or disputes after the owner's death.

What happens if a beneficiary predeceases the property owner?

If a beneficiary named in the Wisconsin 9 form predeceases the property owner, their share of the property would typically revert to the estate of the deceased owner and be distributed according to the owner’s will or, if no will exists, through the intestate succession laws of Wisconsin, unless alternate provisions are specified within the TOD designation.

Is the Wisconsin 9 form only for real estate?

Yes, the Wisconsin 9 form is specifically designed for the transfer on death designation of real estate property located within the state of Wisconsin. Other assets, such as vehicles or financial accounts, may have their own forms and processes for TOD designations.

Where should the Wisconsin 9 form be filed?

The completed Wisconsin 9 form must be filed (or recorded) with the Register of Deeds in the county where the property is located. The form becomes effective upon recording, and it's important to ensure it is completed accurately and in compliance with Wisconsin law to effectively transfer the property to the designated beneficiary upon the owner's death.