Who needs to register their aircraft with the Wisconsin Department of Transportation?

All aircraft based in Wisconsin must be registered with the Wisconsin Department of Transportation, except for those specifically exempted under the guidelines provided in the instructions.

What are the exemptions from aircraft registration in Wisconsin?

There are several exemptions from registration, including aircraft that are severely damaged or in a major state of disrepair (considered unairworthy), incomplete amateur-built aircraft until they become airworthy, and aircraft owned by state, county, or local government and the Civil Air Patrol. Additionally, museum aircraft that are qualified under section 501 of the IRS code and used solely for recreation or display are exempt.

What information is required for the Wisconsin Aircraft Registration form?

The form requires detailed information about the owner(s) including their complete legal name, address, and daytime telephone number. It also asks for the aircraft's FAA “N” number, make, model, year, serial number, gross weight, type of power (engines), and information regarding the aircraft's base location. Details about the purchase or other basis for the registration, such as entry into Wisconsin, construction completion, or restoration, are also required.

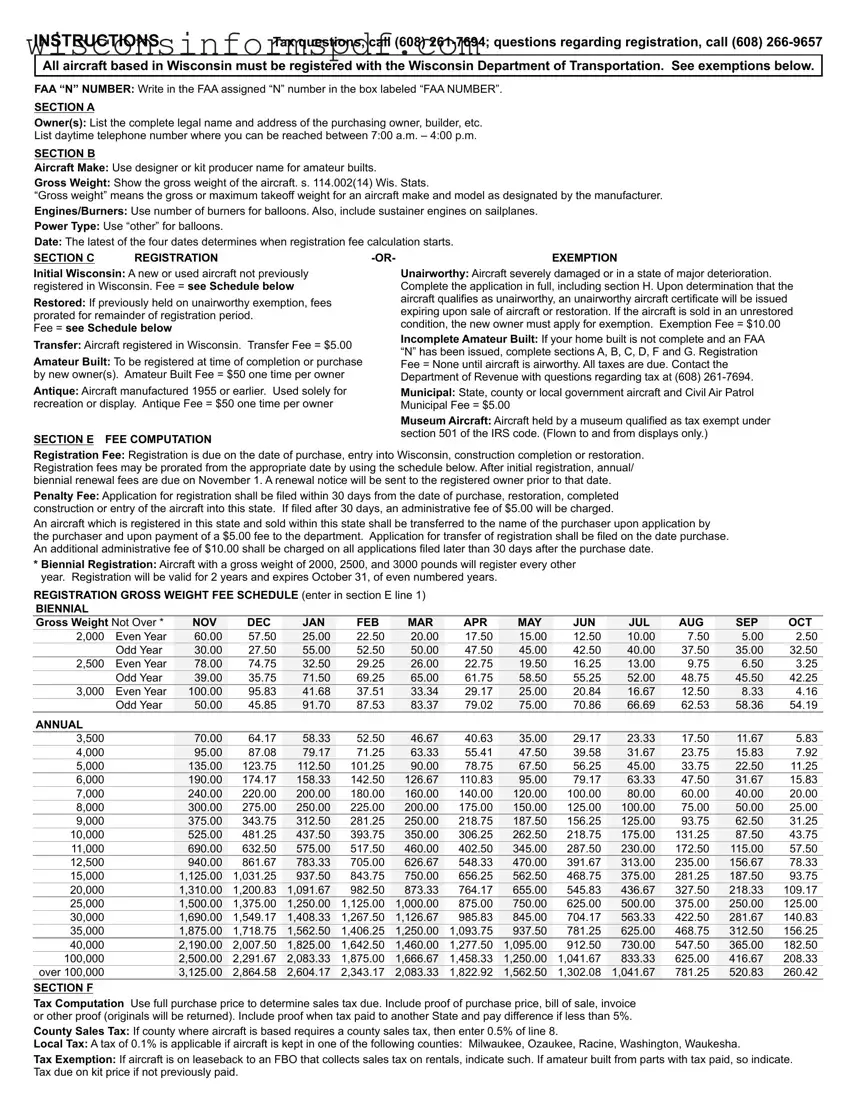

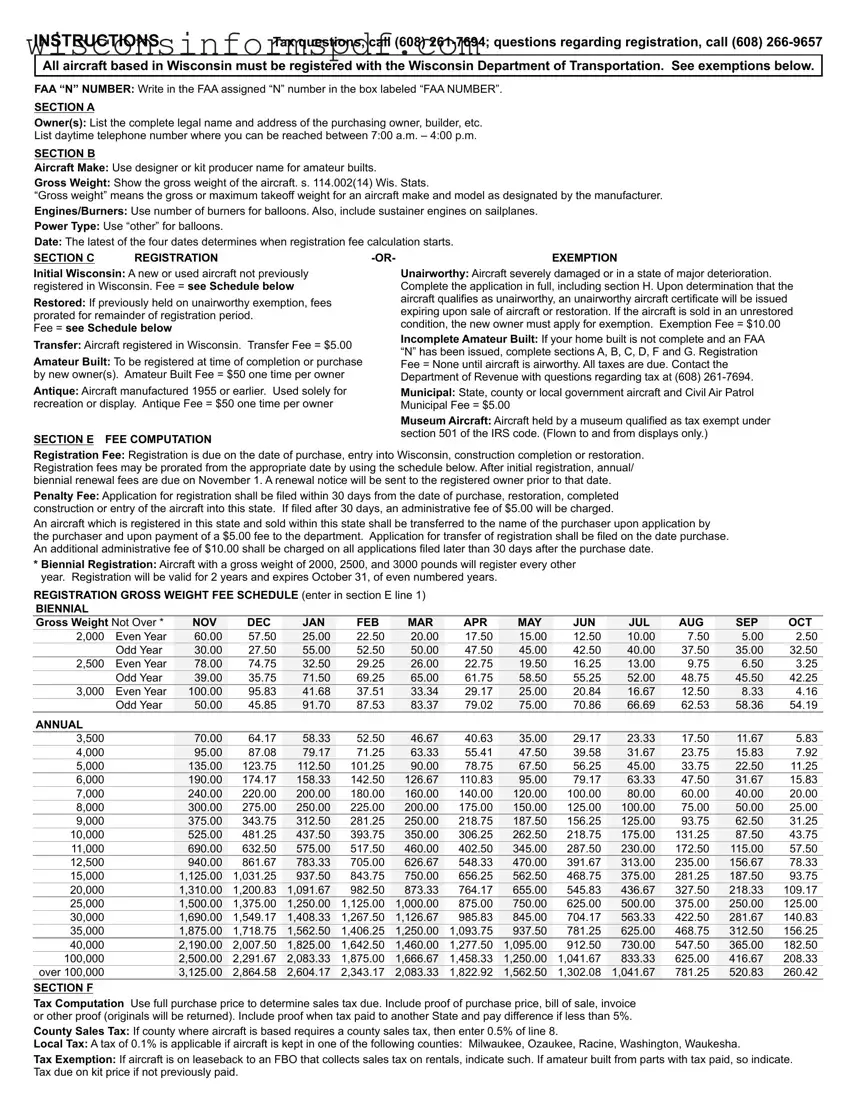

How is the registration fee for an aircraft determined in Wisconsin?

The registration fee is based on the aircraft's gross weight and whether the registration is for an even or odd year, with a schedule provided to calculate the amount due. Fees vary for initial registration, restoration, transfer, amateur-built aircraft, and antiques, with specific amounts outlined in the fee schedule included in the instructions.

What is the penalty for late registration of an aircraft in Wisconsin?

Aircraft owners must file their registration within 30 days of purchase, restoration, completed construction, or entry of the aircraft into Wisconsin. A $5.00 administrative fee is charged for late registration. Additionally, if transferring registration of an aircraft, a $10.00 administrative fee is applied for applications filed more than 30 days after the purchase date.

Are there any fees for transferring aircraft registration to a new owner?

Yes, there is a $5.00 fee for transferring aircraft registration to the name of the new purchaser when the aircraft is sold within Wisconsin.

How does one compute taxes due upon registering an aircraft?

Taxes are computed based on the full purchase price of the aircraft. Owners must include proof of the purchase price and, if applicable, proof of sales tax paid to another state. If the tax paid to another state is less than Wisconsin's rate, the difference must be paid. Local and county sales taxes may also apply depending on where the aircraft is based.

What should an owner do if their aircraft is considered unairworthy?

Owners of unairworthy aircraft must complete the application in full, including a statement about the aircraft's condition and an estimated date of repair if applicable. Upon verification, an unairworthy aircraft certificate will be issued, expiring upon sale of the aircraft or its restoration. If sold in an unrestored condition, the new owner must apply for the exemption and pay a $10.00 fee.