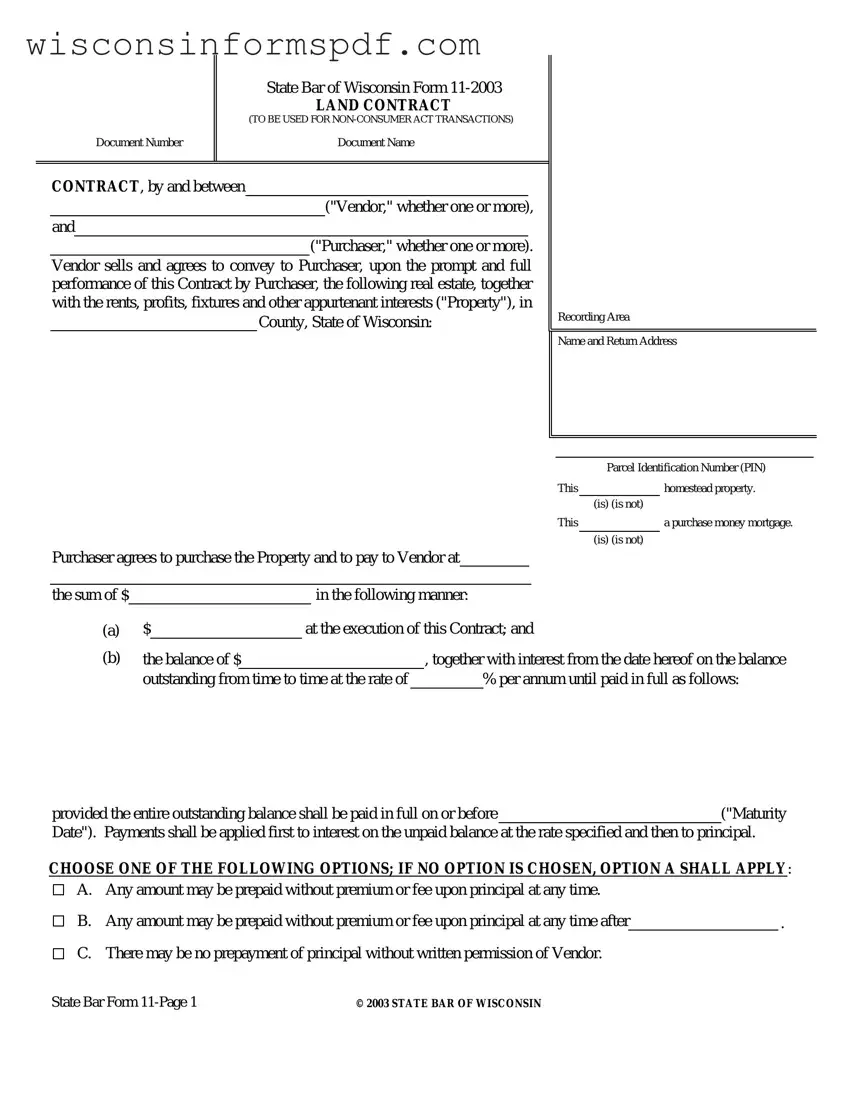

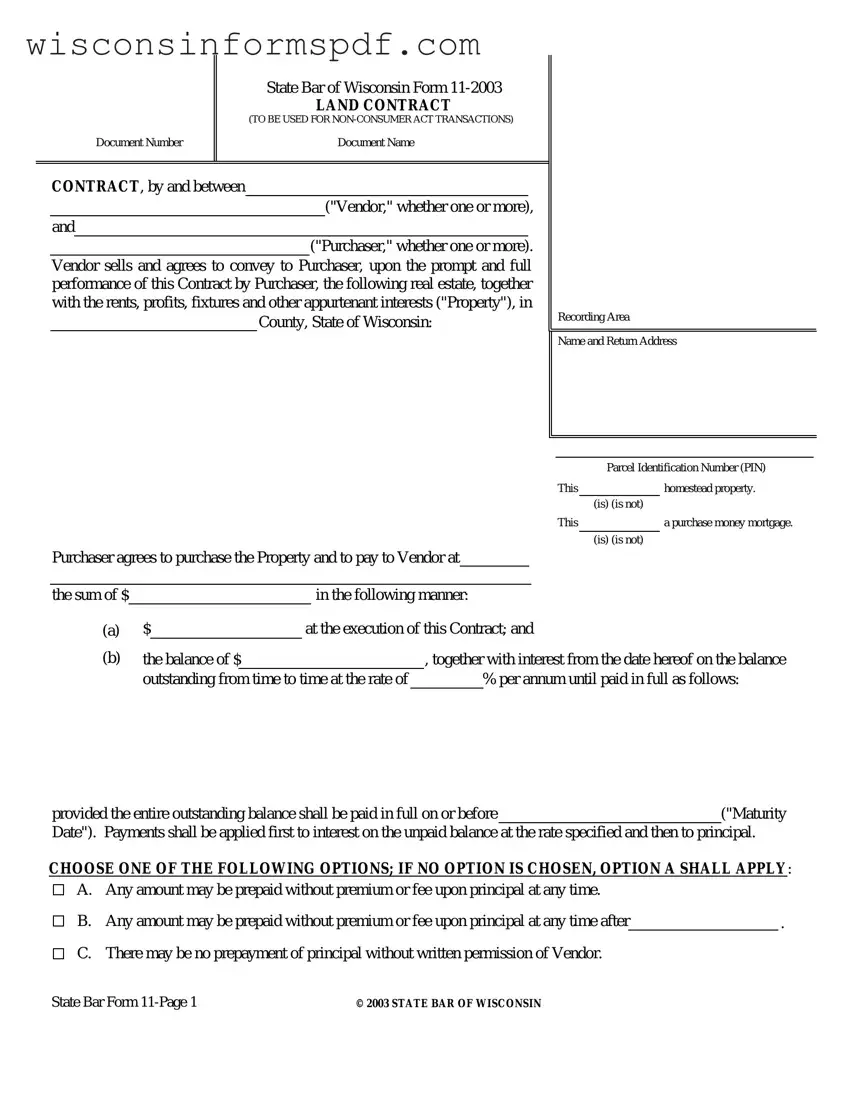

The Wisconsin Land Contract form shares similarities with the real estate purchase agreement, primarily in its function to outline the terms under which the sale of property is agreed upon between a buyer and a seller. Similar to the real estate purchase agreement, the land contract lays down payment schedules, interest rates, and the conditions under which the property's ownership will be transferred to the buyer, ensuring both parties are clear on the expectations and legal obligations from the outset. Both documents serve to protect the interests of each party while providing a clear path forward for the transfer of real estate ownership.

Mortgage agreements are another type of document closely related to the Wisconsin Land Contract form, as both detail financing arrangements for the acquisition of property. While the land contract acts as a seller-financed mortgage where the buyer makes payments directly to the seller until the full price is met, a traditional mortgage involves a banking institution or lender providing the funds for the purchase upfront, with the buyer then making payments to the financial institution. Each serves the purpose of structuring the payment and ownership transfer process but involves different parties in the financing role.

A Promissory Note is akin to the Wisconsin Land Contract form in its commitment to pay a specified amount over a period. Within the land contract, the purchaser agrees to pay the seller a predetermined sum, akin to how a promissory note binds the borrower to repay the lender. Both documents establish payment schedules, interest rates, and the conditions of repayment, though the promissory note is typically more focused on the repayment of a loan, rather than tied directly to the exchange of real property.

Warranty deeds bear resemblance to the concluding provision of a Wisconsin Land Contract form, which stipulates the transfer of property with certain guarantees about the property's title. Upon the completion of payments under a land contract, the seller is required to provide a warranty deed to the buyer, ensuring the title is free from liens or encumbrances except those made by the buyer. Both documents play crucial roles in the final transfer and assurance of clean title in real estate transactions.

Quitclaim deeds, while less comprehensive in guarantees compared to warranty deeds referenced in the land contract's closing provisions, also relate closely to the Wisconsin Land Contract by involving the transfer of property rights. A quitclaim deed transfers the seller's interest in a property to the buyer without any warranties on the title's status, which contrasts the assurance provided once a land contract is fulfilled and a warranty deed is issued. However, both are critical in the step-by-step process of transferring real estate ownership.

Title insurance policies complement the protective aspects of the Wisconsin Land Contract form by offering a mechanism to defend against future disputes over property ownership and potential defects in the title not identified prior to the sale. The land contract mentions title evidence and the future provision of title insurance as an option, underscoring the importance of safeguarding against unforeseen title issues that could affect ownership rights, much like a standalone title insurance policy aims to do.

Lease agreements, while catering to a different arrangement than the outright sale in a Wisconsin Land Castellano Contract, share the element of property usage agreements between two parties. The land contract transitions the property ownership gradually as payments are made, similar to how lease agreements allow for the use of property in exchange for rent, albeit without the transfer of ownership. Both documents regulate the terms under which one party utilizes property belonging to another.

Homeowners' association (HOA) agreements can also be considered in parallel to aspects of the Wisconsin Land Contract form, especially regarding the stipulation of compliance with laws, ordinances, and regulations. While the land contract might not directly deal with HOA rules, the necessity for a purchaser to adhere to existing regulations and conditions affecting the property resonates with the expectations set forth in HOA agreements for community members.

Construction loans share a financing connection with the Wisconsin Land Contract form, focusing on the specific purpose of financing new construction or property improvements. While the land contract arranges the overall purchase financing directly through the seller, construction loans involve lending money for the express purpose of building or renovating, demonstrating another facet of real estate financing where the structure of payments and completion of certain conditions precede the final ownership transfer or project completion.

Lastly, the option to purchase agreements resemble the Wisconsin Land Contract form by offering a structured approach to real estate transactions where a potential buyer gains the right to purchase a property at an agreed-upon price within a specific timeframe. Though the land contract directly involves the gradual process of buying property over time, both types of agreements create a framework within which real estate can change hands, affirming conditions and terms before the final sale is realized.