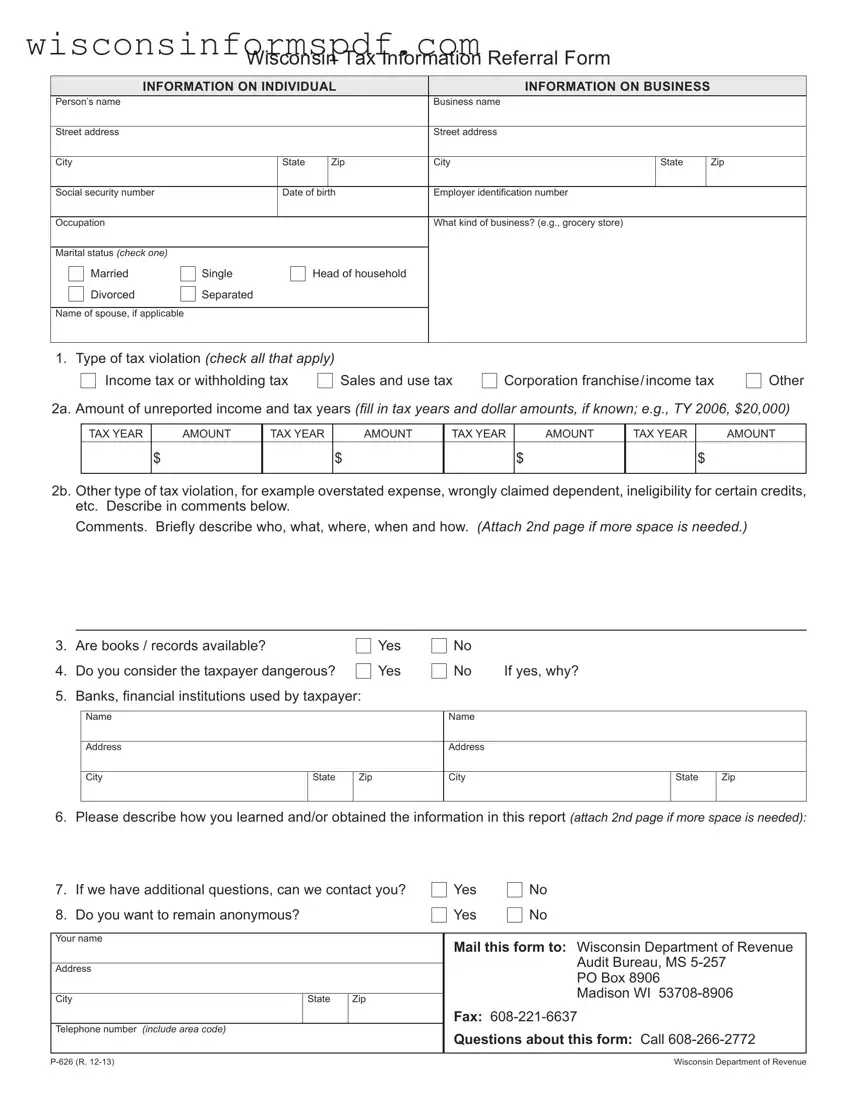

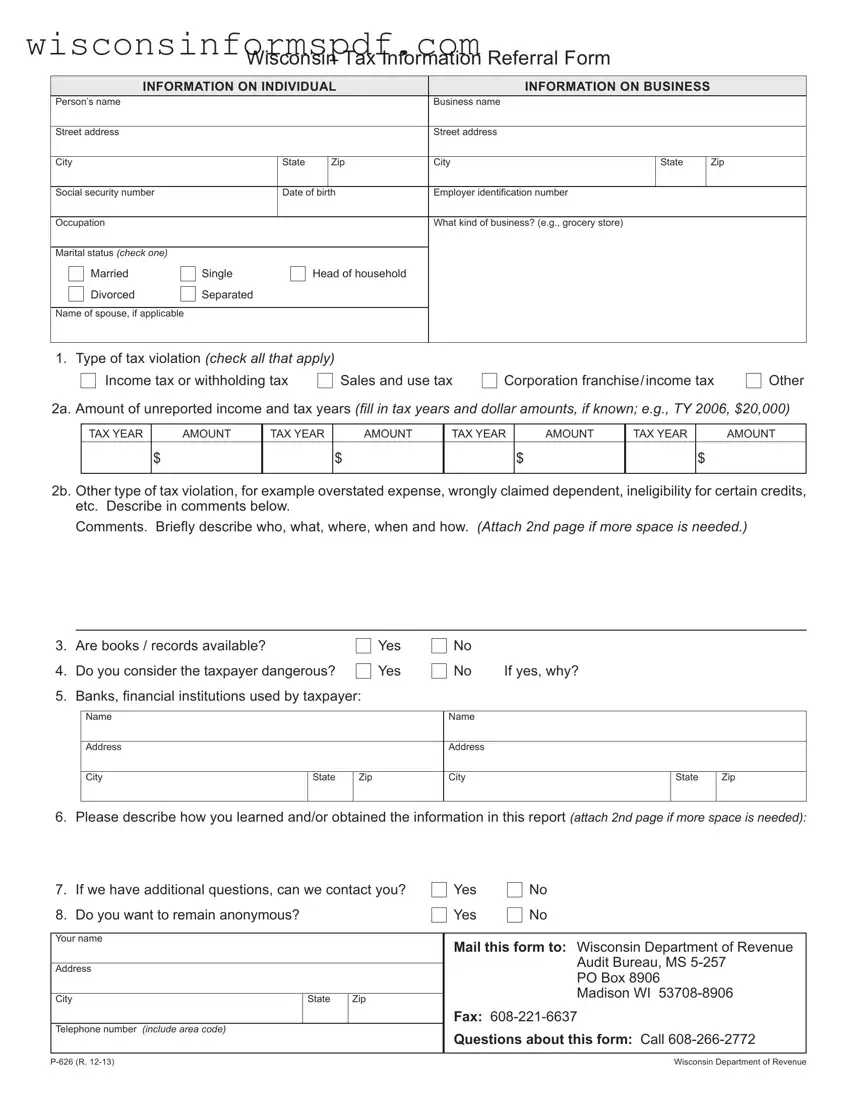

The Federal Form 3949-A, "Information Referral," used by the IRS for reporting suspected tax fraud, is quite similar to the Wisconsin P 626 form. Both documents collect detailed personal and business information, including names, addresses, and social security or employer identification numbers. They also ask for specifics about the alleged tax violation, such as the type of tax issue (income, sales, etc.), and provide space for the claimant to describe the violation in detail, like unreported income or incorrect deductions. The forms are designed to streamline the process of reporting tax violations to the respective tax authority, helping in the investigation of tax evasion or fraud.

The Form 211, "Award for Original Information," also parallels the Wisconsin P 626 form in that it's used by the IRS Whistleblower Office to report tax evasion. Although its primary purpose is to apply for a financial award, it similarly requests detailed tax violation information, including types of taxes involved, and amounts of unreported income or overstated expenses. Where the P 626 form is specifically for reporting potential tax violations without the expectation of reward, both forms play crucial roles in uncovering tax malfeasance, highlighting the whistleblower's role in tax law enforcement.

Sarbanes-Oxley Act (SOX) whistleblower forms, used for reporting corporate fraud, echo aspects of the Wisconsin P 626 form through their focus on collecting detailed reports of alleged wrongdoing. While SOX forms are broader, covering various types of corporate misconduct beyond tax violations, they share the core function of documenting specific allegations. They request descriptions of the misconduct, including the "who, what, where, when, and how," similar to the detailed descriptions and comments section in the P 626 form. Both empower individuals to report misconduct, aiming to bring about corporate or fiscal accountability.

The Financial Crimes Enforcement Network (FinCEN) Suspicious Activity Reports (SARs) bear resemblance to the P 626 form in their objective to combat fraud, money laundering, and other financial crimes. Like the P 626, SARs require detailed information about the parties involved, including personal and business identifiers, and the nature of the suspicious activity. Though SARs are more focused on financial transactions and the banking sector, both forms are vital tools for federal and state agencies to investigate and penalize unlawful financial activities.

The Department of Labor's (DOL) WH-380, used for reporting violations of the Fair Labor Standards Act (FLSA), while differing in focus—employment law versus tax law—utilizes a similar reporting mechanism to the P 626. It collects detailed information about the employer and employee, and specifics about the alleged violation. Both forms serve as formal complaints that trigger investigations by the respective authority, ensuring adherence to state or federal laws and protecting individuals' rights within their employment or tax obligations.

The HUD Housing Discrimination Complaint Form, like the Wisconsin P 626 form, is designed for reporting specific allegations—this time of housing discrimination rather than tax fraud. It collects detailed information about the complainant, the party alleged to have committed the discrimination, and a description of the alleged discriminatory act. Although addressing different areas of law, both forms share the aim of enforcing legal standards through the reporting of violations, allowing authorities to investigate and address the reported misconduct.

The SEC Form TCR (Tip, Complaint or Referral), utilized by the Securities and Exchange Commission, is another document structured similarly to the Wisconsin P 626 form. It is intended for reporting violations of securities laws, with sections for detailed information about the individuals or entities involved, explanation of the suspected misconduct, and any additional documents that can substantiate the claim. Although focused on securities rather than tax law, the SEC Form TCR and the P 626 form alike encourage individuals to report wrongdoing, facilitating regulatory oversight and enforcement actions.