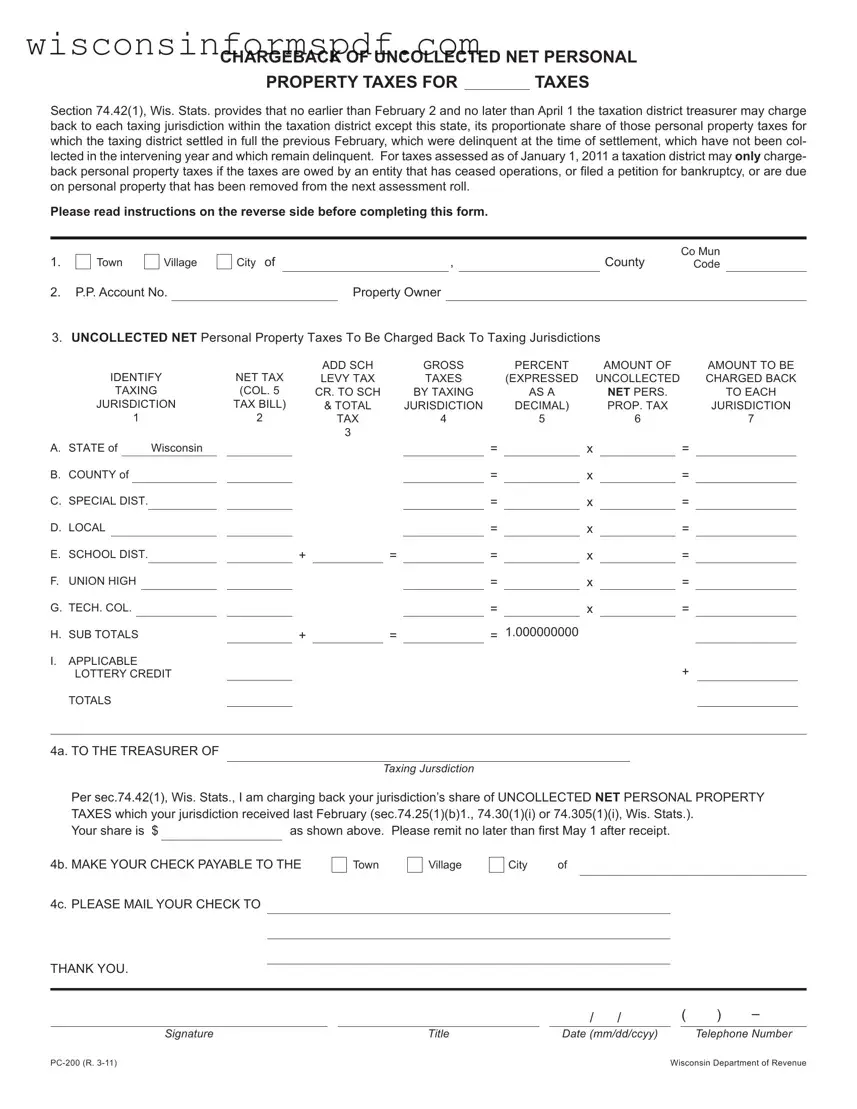

What is the Wisconsin PC 200 form?

The Wisconsin PC 200 form, also known as the "Chargeback of Uncollected Net Personal Property Taxes" form, is a financial document used by taxation district treasurers in Wisconsin. It allows them to charge back to each taxing jurisdiction within the district (except the state) their proportionate share of personal property taxes that were delinquent at the time of settlement, have not been collected in the past year, and remain delinquent. This process is detailed under Section 74.42(1) of the Wisconsin Statutes.

When should the PC 200 form be completed and submitted?

The form must be completed and sent no earlier than February 2 and no later than April 1 following the year in which the personal property taxes remain uncollected. This deadline allows taxation districts to reconcile uncollected taxes in a timely manner, ensuring that affected taxing jurisdictions are informed and can adjust their financial planning accordingly.

Who needs to be notified with the completion of the PC 200 form?

Upon completion, a copy of the PC 200 form needs to be sent to the treasurer of each taxing jurisdiction that has an entry greater than zero in the calculated chargeback amounts, with the exception of local and state jurisdictions. Additionally, the tax district clerk and each affected taxing jurisdiction should receive a copy of this form. This ensures that all parties involved are aware of the uncollected amounts and the impact on their financial planning.

How is the amount to be charged back to each jurisdiction calculated?

The calculation involves determining each jurisdiction's proportionate share of the uncollected net personal property taxes by applying the percentage of the jurisdiction's share of the total taxes (to nine decimal points) to the amount of qualifying uncollected net personal property tax. This complex calculation considers the net taxes from the tax bill, adding any applicable school levy tax credit to the school tax and the total tax to get the actual gross tax. From this, each jurisdiction's percentage share is applied to find the amount to be charged back.

Are there any special circumstances where the PC 200 form cannot be used?

Yes, for taxes assessed as of January 1, 2011, a taxation district may only chargeback personal property taxes if those taxes are owed by an entity that has ceased operations, filed a petition for bankruptcy, or are due on personal property that has been removed from the next assessment roll. This limitation aims to ensure that chargebacks are pursued only in situations where collection efforts are unlikely to be successful due to the debtor's circumstances.

What should be done after completing the form?

After completing the form, the taxation district treasurer should mail it to the treasurer of each affected taxing jurisdiction, along with making the necessary financial adjustments in their records. Retaining the original worksheet and ensuring that a copy is sent to both the tax district clerk and each affected taxing jurisdiction is crucial for maintaining transparency and proper documentation of the chargeback process.

Where can I get assistance or more information on completing the PC 200 form?

For assistance or further information on completing the PC 200 form, taxation district treasurers and other officials can contact the Wisconsin Department of Revenue's Local Government Services Section via email at lgs@revenue.wi.gov, or by calling (608) 261-5341. They provide guidance and support to ensure the form is completed accurately and in compliance with Wisconsin's statutory requirements.