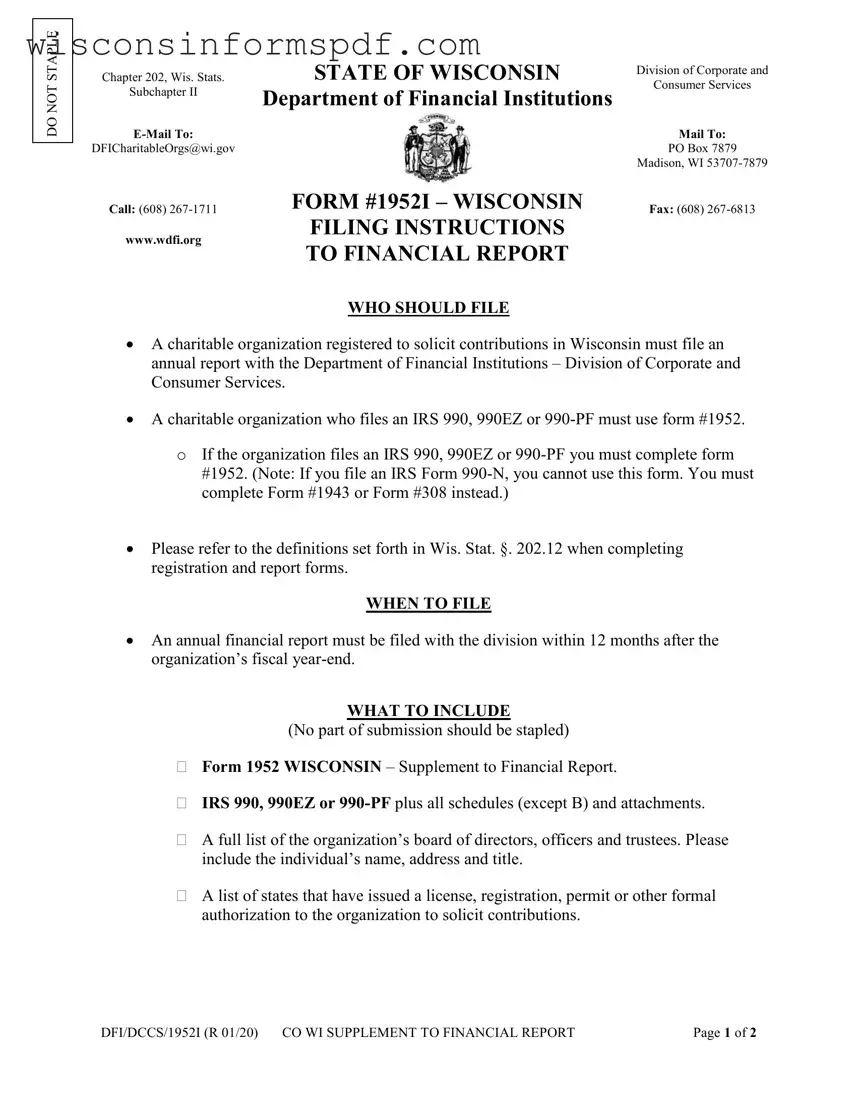

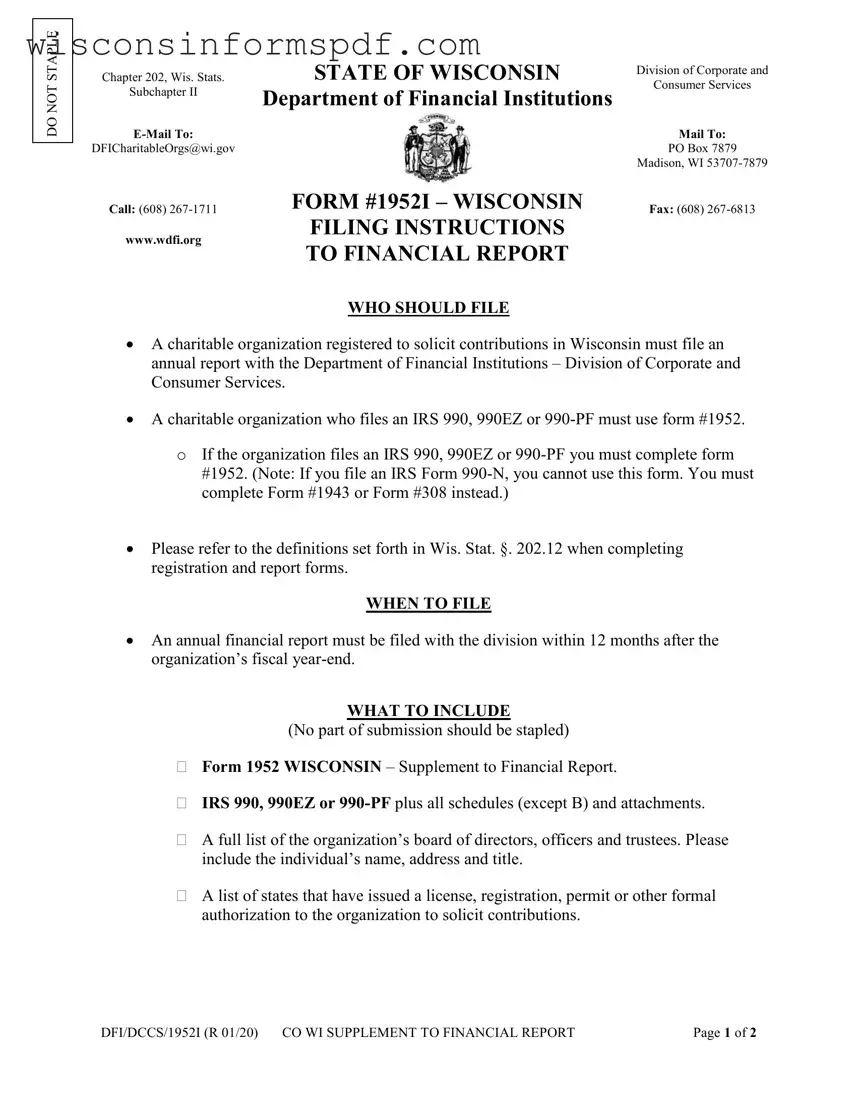

The Wisconsin form shares similarities with various other documents required for regulatory or compliance purposes across different sectors and states. Each of these documents serves to ensure transparency, accountability, or financial integrity within its respective domain. Here are ten documents that are similar in purpose or content to the Wisconsin form:

The IRS Form 990, which is referenced in the Wisconsin form, is a principal document that nonprofit organizations use to provide the public with financial information about themselves. It is also used by government agencies to prevent organizations from abusing their tax-exempt status. Similar to the Wisconsin form, IRS Form 990 requires detailed financial data, lists of key employees and directors, and descriptions of an organization's activities and governance.

The California Statement of Information (Form SI-100) must be filed by corporations and LLCs in California. It includes information on the principal address, directors, officers, and agent for service of process, paralleling the requirements in the Wisconsin form for organizations to submit details on their trustees and directors.

New York's Charities Bureau Annual Filing for Charitable Organizations (Form CHAR500) mandates that charitable organizations provide financial reports along with a list of key personnel, similar to what the Wisconsin form requires. This ensures that charitable organizations operate transparently and in accordance with the law.

Florida's Solicitation of Contributions Act requires a similar annual financial report from organizations soliciting donations within the state. This report demands details of revenue and expenses, ensuring donors can understand where their contributions are going, akin to the financial declarations required in the Wisconsin form.

The Illinois Attorney General’s Charitable Organization Annual Report, akin to the Wisconsin form, requires charities to submit financial statements and information about their programs and activities. This helps the public and authorities to ascertain the legitimacy and effectiveness of charitable operations within the state.

Michigan’s Charitable Trust Section Annual Report asks for financial statements, details about fundraising activities, and information on governance, mirroring the Wisconsin form's requirements for a comprehensive overview of an organization’s financial health and operations.

The Pennsylvania Bureau of Corporations and Charitable Organizations Annual Registration Statement requires similar information to the Wisconsin form, including financial statements, organizational structure, and fundraising activities to ensure charities comply with state regulations.

The Texas Annual Unified Registration Statement, used by some charitable organizations to fulfill state charity registration requirements, collects detailed information on finances, governance, and fundraising practices, reflecting the comprehensive nature of the Wisconsin form's data requirements.

The Colorado Charitable Solicitations Act Registration Statement necessitates that charities provide financial documents, a list of officers and directors, and information on fundraising activities. This ensures transparency and accountability, much like the aim of the Wisconsin form.

Finally, the Georgia Charities Disclosure Form mandates detailed financial reporting and organizational information from charities operating within the state. This promotes transparent charity operations, reinforcing the objectives laid out in the Wisconsin form to ensure responsible financial management and openness.

Yes

Yes