What is the purpose of the Wisconsin Rent Certificate form?

The Wisconsin Rent Certificate form is used to verify the rent paid for a residence in Wisconsin during a specific tax year. It's a required document for renters who are filing for a homestead credit claim with their tax returns. The information provided on this form helps the Wisconsin Department of Revenue assess eligibility and calculate the amount of credit a renter may receive.

Who needs to fill out and sign the Wisconsin Rent Certificate?

The landlord or an authorized representative of the property owner must complete and sign the rent certificate. The renter provides their personal information and residency details but does not sign the form. If the landlord refuses to sign, the renter must still complete their part, attach rent verification such as canceled checks or bank money orders, and note the refusal by checking the designated area.

Can alterations be made to the Wisconsin Rent Certificate once it's filled out?

No, alterations such as whiteouts, erasures, or any errors can void the rent certificate. It's essential to fill out the form carefully and accurately to ensure it's accepted. If mistakes are made, a new form should be completed and signed.

What if my landlord refuses to sign the Wisconsin Rent Certificate?

If your landlord won't sign the certificate, you should complete the information to the best of your ability, attach verification of rent paid like copies of canceled checks or bank money orders, and check the box indicating your landlord's refusal to sign. This allows you to still file for the homestead credit, although the Department of Revenue may request additional verification.

What information is needed to complete the Wisconsin Rent Certificate?

To complete the rent certificate, information about the rental property, the rent paid, the rental period, the number of occupants, and details about any services provided by the landlord (such as utilities or food) are required. Landlords must provide specific details about the rent collected, and renters must specify their personal information, including their social security number after the landlord parts are filled.

Is the Wisconsin Rent Certificate necessary for all renters seeking a homestead credit?

Yes, the rent certificate is required for all renters who wish to claim the homestead credit on their Wisconsin tax return. Without this form, or if the form is incomplete or incorrectly filled out, the claim for the credit may be denied or delayed.

How does shared living affect the rent certificate?

If renters share living expenses, they must indicate this by answering "No" to line 5b on the form. They then complete the Shared Living Expenses Schedule, which helps calculate each renter's share of the rent paid for eligibility and credit calculation purposes. Each occupant’s share of rent and utilities is used to accurately determine the allowable credit.

Are rent contributions from governmental agencies included in the total rent paid on the Wisconsin Rent Certificate?

No, amounts received directly from governmental agencies, such as subsidies, vouchers, or grants, should not be included in the total rent paid figure on the rent certificate. Only out-of-pocket rent payments made by the renter are considered for the credit calculation.

What happens if incorrect information is provided on the Wisconsin Rent Certificate?

If incorrect information is submitted on the rent certificate, it may result in the denial or delay of the homestead credit claim. It's crucial to ensure all the information is accurate and truthful. If errors are found after submission, it is advisable to contact the Wisconsin Department of Revenue for guidance on how to correct the information.

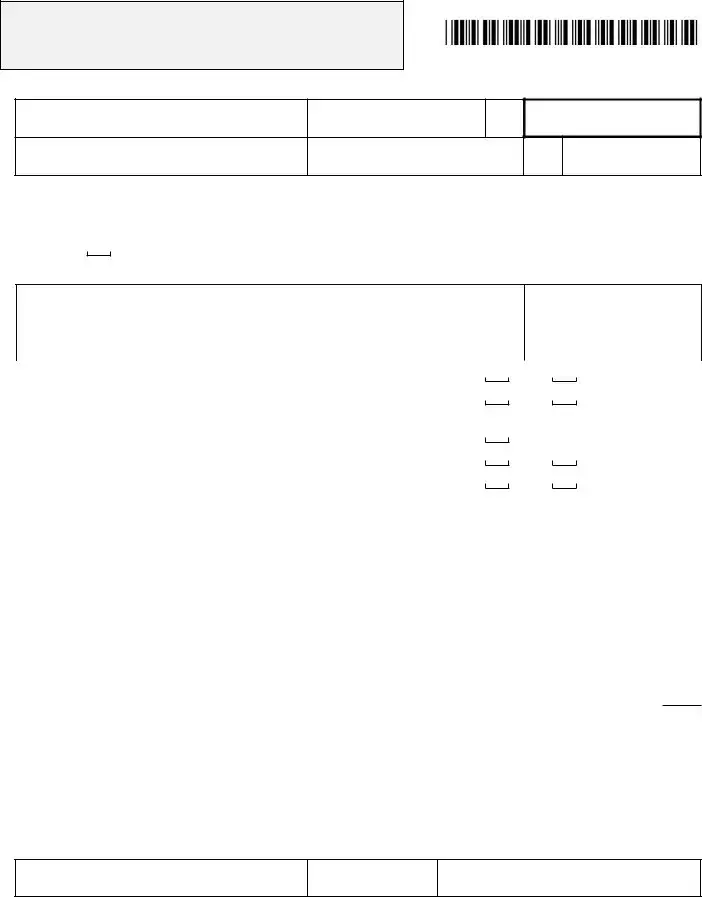

Renter (Claimant) – Enter Social Security Number AFTER your landlord fills in section below and signs.

Renter (Claimant) – Enter Social Security Number AFTER your landlord fills in section below and signs. Landlord or Authorized Representative

Landlord or Authorized Representative I certify that the information shown on this rent certificate is true, correct, and complete to the best of my knowledge.

I certify that the information shown on this rent certificate is true, correct, and complete to the best of my knowledge.