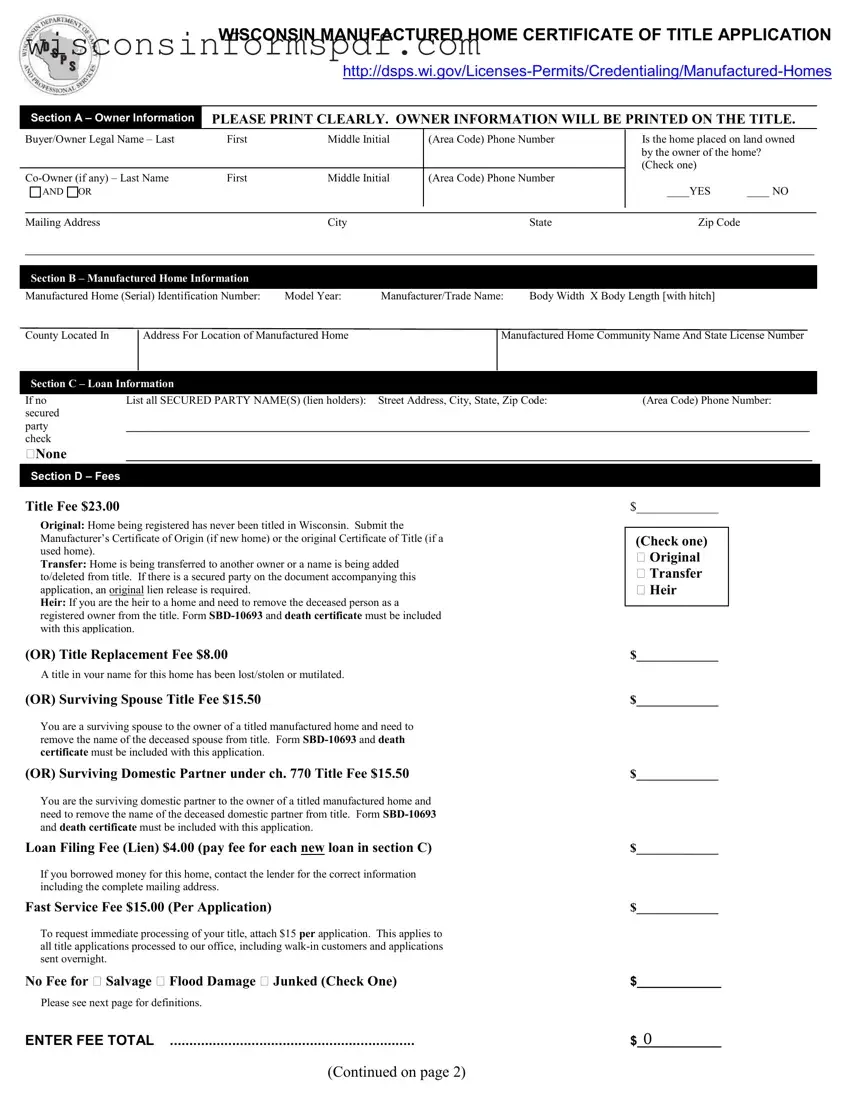

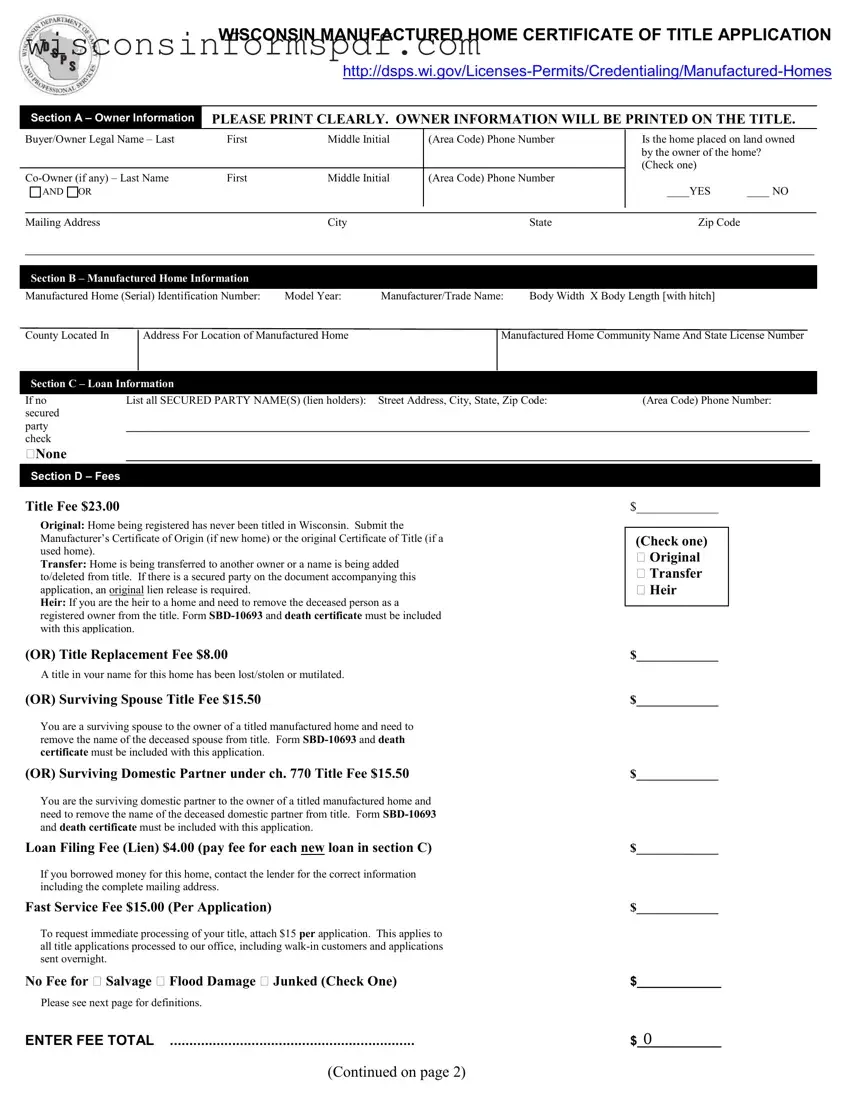

The Wisconsin SBD 10687 form, which is a Manufactured Home Certificate of Title Application, bears similarities to an Automobile Title Application found in many states. Both applications share the common purpose of establishing legal ownership and are required for the vehicle or manufactured home owner to demonstrate clear ownership. These documents typically include owner information, vehicle or manufactured home identifying features such as make, model, and serial number, and information pertaining to any lien on the property. The clear intention is to document ownership and any encumbrances on the title clearly.

Similarly, a Boat Registration and Title Application found in several jurisdictions mirrors the need to register and title a manufactured home. Boat registrations, like the SBD 10687, collect detailed information about the vessel, including length, manufacturer, and hull identification number. Both registrations are critical for documenting the legal ownership of significant personal property items and ensuring the state's record-keeping and tax collection efforts are accurate and up to date.

Another closely related document is a Mobile Home Tax Certification form, which municipalities require to ensure all property taxes have been paid before a mobile or manufactured home is sold or relocated. While primarily focused on tax status, this form complements the title application process by providing an additional layer of legal assurance regarding the property's standing. Both forms are fundamental in the transfer and registration process, ensuring no outstanding financial obligations are associated with the property.

The UCC-1 Financing Statement form also shares similarities with the Wisconsin SBD 10687 form. It is used to record a secured transaction on personal property, including manufactured homes, to establish priority in case of debtor default. Both documents play key roles in the financial and legal aspects of owning significant property, ensuring that any liens or encumbrances are made public record to protect the interests of secured parties and owners alike.

The Department of Motor Vehicles (DMV) Change of Address Form, while more general, connects with the manufactured home title application in terms of updating official records. Owners of manufactured homes, like drivers or vehicle owners, must notify the relevant state department of any address changes to ensure they receive important correspondence related to their property, including renewal notices, tax bills, and other legal documents.

A Certificate of Occupancy is another document that, while broader in scope, relates to the certification process of a manufactured home. This certificate is proof that a building, including manufactured homes placed on a property, complies with local building codes and zoning laws. It's crucial for the legal inhabitation of the property. Both certificates ensure that the dwelling meets specific standards and is suitable for occupancy or ownership in compliance with local regulations.

Real Estate Purchase Agreement forms outline the terms and conditions of the sale of property, including manufactured homes. They detail the agreement between buyer and seller, similar to how the Wisconsin SBD 10687 form details the transaction for a title change. Although serving different stages of the transaction process, both documents are pivotal for the legal transfer of ownership and ensuring the rights and obligations of all parties are clearly defined and agreed upon.

A Lien Release form is directly associated with the SBD 10687 form, particularly in transactions involving financed properties. When a lienholder has been paid off, a Lien Release must be filed to remove the lien from public record, similar to updating the manufactured home's title to reflect changes in ownership or encumbrances. Both forms are critical for maintaining accurate records of the property's financial standing and ownership.

Lastly, a Personal Property Tax Declaration form, required by some jurisdictions, encompasses the valuation and taxation of movable non-real estate property, which can include manufactured homes. These declarations help local governments assess and collect taxes on valuable personal property. In conjunction with the manufactured home title application, this declaration ensures that owners are properly taxed based on the current value and status of their property, reflecting a comprehensive approach to property management and taxation.