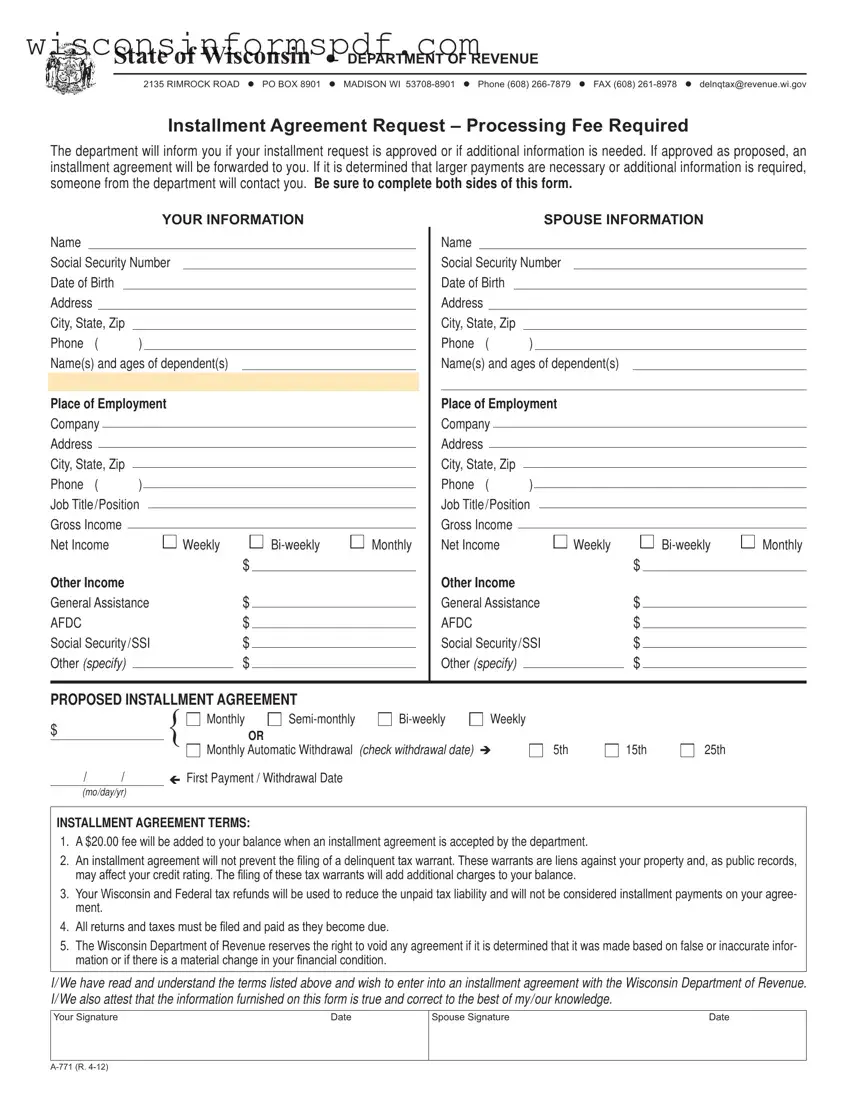

What is the A-771 form used for in Wisconsin?

The A-771 form is an Installment Agreement Request form used in Wisconsin. It allows individuals to request a payment plan for their delinquent taxes. This form is required when individuals cannot pay their taxes in full and need to make arrangements to pay in installments. Upon approval, the Department of Revenue sets up a structured payment plan based on the provided financial details.

Is there a fee to submit the A-771 form?

Yes, when an installment agreement is accepted by the Wisconsin Department of Revenue, a $20.00 processing fee is added to the balance owed. This fee covers the administrative costs associated with setting up the installment plan.

Can filing an installment agreement prevent delinquent tax warrants in Wisconsin?

No, filing an installment agreement will not prevent the filing of delinquent tax warrants. These warrants serve as liens against the property of the taxpayer and can adversely affect their credit rating. Tax warrants also result in additional charges being added to the taxpayer's balance owed to the state.

Will Wisconsin and federal tax refunds be applied to my installment plan?

Any Wisconsin and federal tax refunds you receive while under an installment agreement will not count as installment payments. Instead, these refunds will be used to reduce your overall unpaid tax liability. This means that while your balance owed might decrease, it does not replace the need to make regular payments as outlined in your agreement.

What happens if I don't file or pay future taxes while under an installment agreement?

It is required that all returns and taxes be filed and paid as they become due, even when an installment agreement is in place. Failure to comply with current tax obligations may lead to the Wisconsin Department of Revenue cancelling the installment agreement, which could result in immediate collection actions for the full amount owed.

Can the Wisconsin Department of Revenue cancel my installment agreement?

Yes, the agreement can be voided by the Wisconsin Department of Revenue if it is found that information provided was false or inaccurate, or if there is a significant change in your financial condition. It is important to provide accurate information and notify the department of any changes in your financial situation to avoid cancellation of your payment plan.

How do I choose my first payment or withdrawal date on the form?

When completing the A-771 form, you can select a first payment or withdrawal date by checking the appropriate box for either the 5th, 15th, or 25th of the month. This allows you to choose a date that aligns with your financial situation and payment preferences.

What information is needed on the A-771 form?

The form requires detailed personal information, including your name, social security number, date of birth, and contact information. Additionally, it asks for employment details, income, information about your spouse (if applicable), and proposed installment agreement details. You must also provide comprehensive information about your assets, expenses, and financial institutions.

How do I submit the A-771 form to the Wisconsin Department of Revenue?

The completed form can be submitted to the Wisconsin Department of Revenue via mail or fax. The mailing address is provided on the form, as well as the fax number for those who prefer to fax their request. Make sure to complete both sides of the form and provide all required information to avoid delays in processing.

What should I do if my financial situation changes after submitting the A-771 form?

If your financial situation changes after submitting the form, it is important to contact the Wisconsin Department of Revenue as soon as possible. Changes in your financial situation may affect your installment agreement, and the department may need to adjust your payment plan accordingly. Keeping the department informed helps ensure that your agreement remains in good standing.