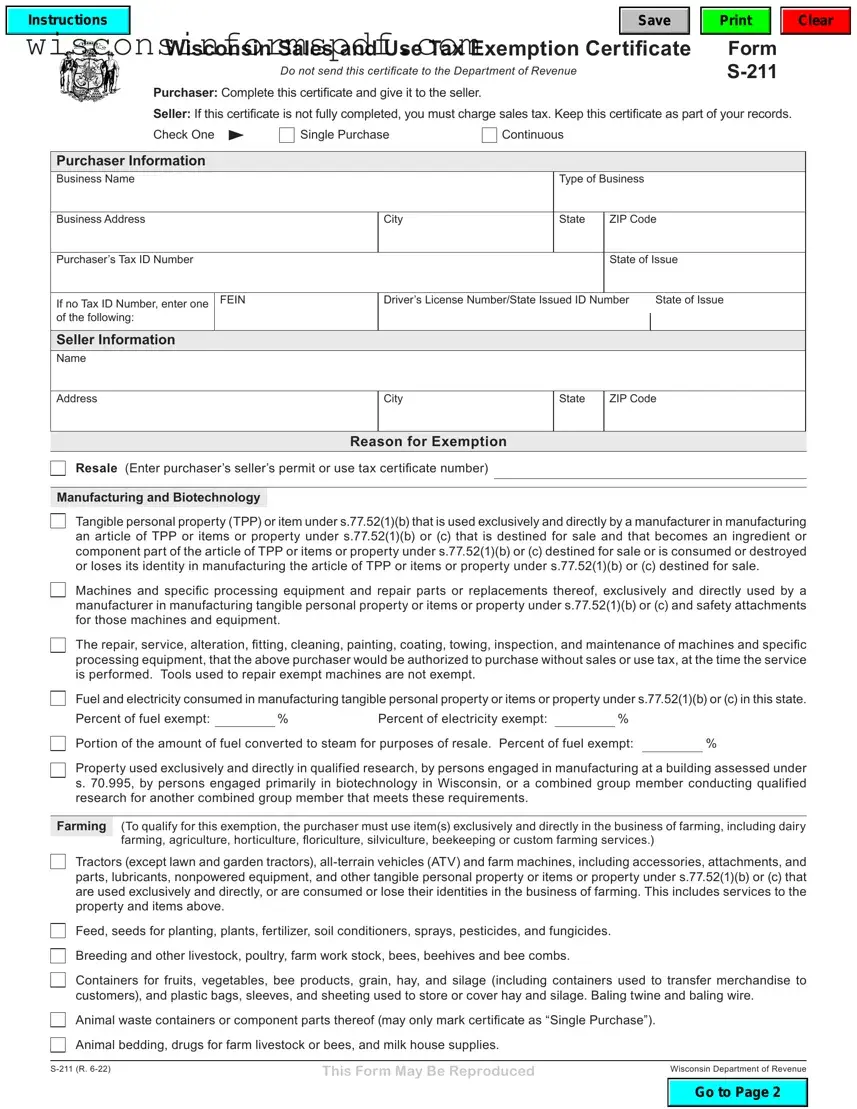

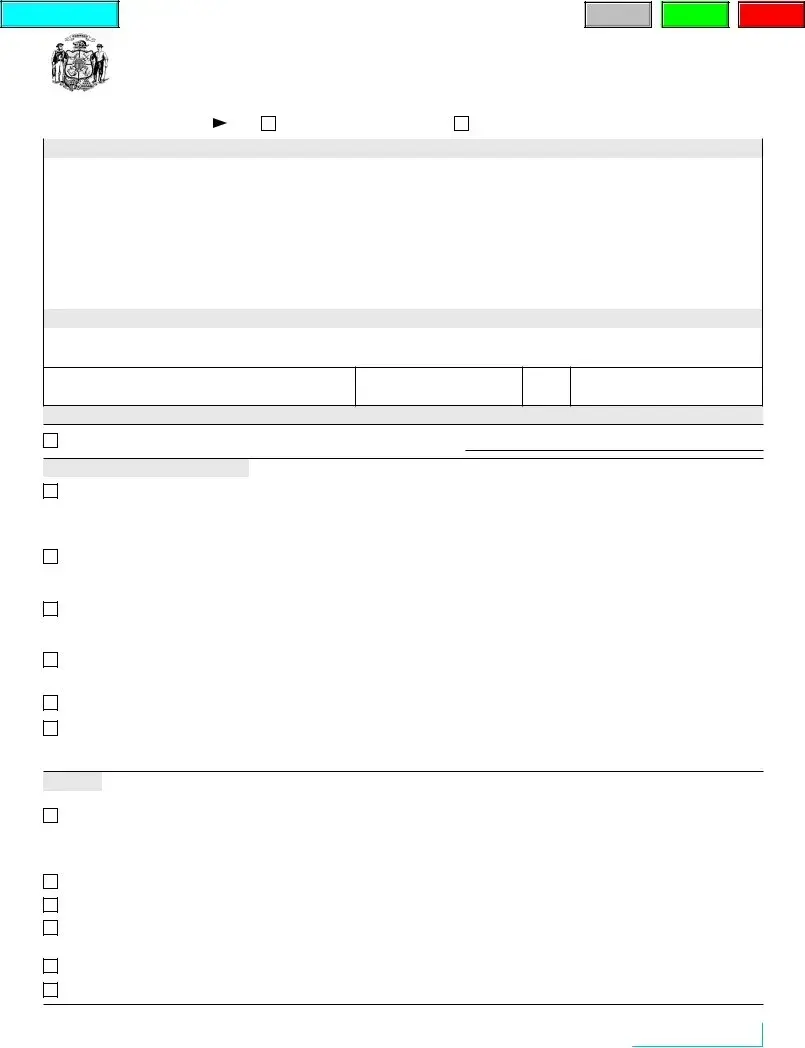

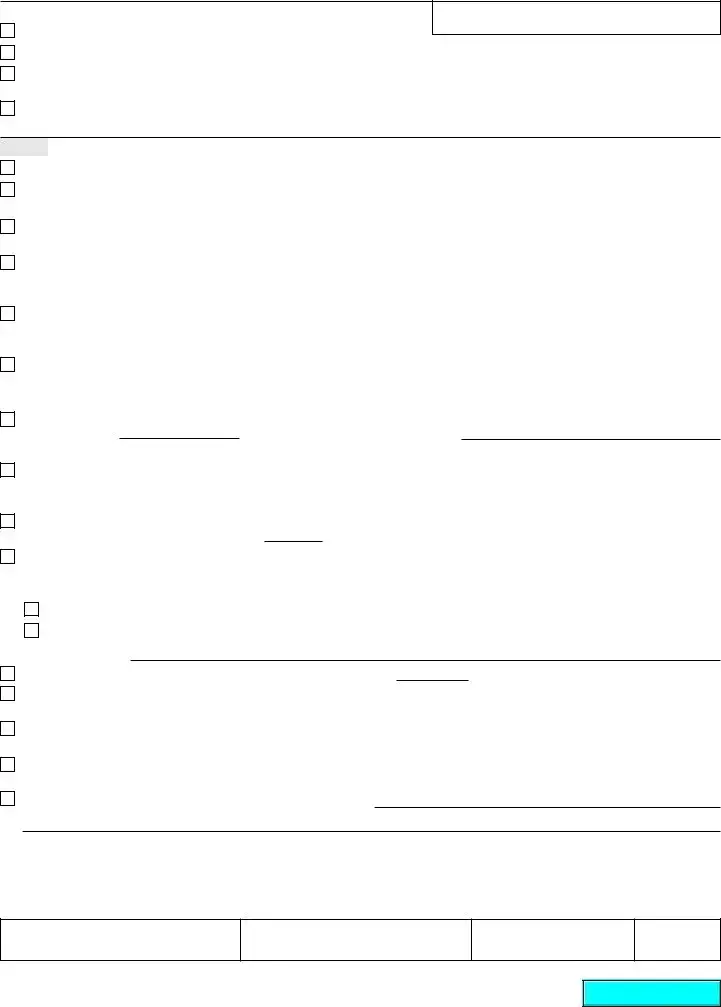

Governmental Units and Other Exempt Entities |

|

Enter CES No., if applicable |

|

|

The United States and its unincorporated agencies and instrumentalities. Any federally recognized American Indian tribe or band in this state.

Wisconsin state and local governmental units, including the State of Wisconsin or any agency thereof, Wisconsin counties, cities, villages, or towns, and Wisconsin public schools, school districts, universities, or technical college districts.

Organizations meeting the requirements of section 501(c)(3) of the Internal Revenue Code. Wisconsin organizations must enter a CES number above.

Other

Containers and other packaging, packing, and shipping materials, used to transfer merchandise to customers of the purchaser. Trailers and accessories, attachments, parts, supplies, materials, and service for motor trucks, tractors, and trailers which are

used exclusively in common or contract carriage under LC, IC, or MC No. (if applicable) |

|

. |

Machines and specific processing equipment used exclusively and directly in a fertilizer blending, feed milling, or grain drying operation, including repair parts, replacements, and safety attachments.

Building materials acquired solely for and used solely in the construction or repair of holding structures used for weighing and dropping feed or fertilizer ingredients into a mixer or for storage of such grain, if such structures are used in a fertilizer blending, feed milling, or grain drying operation.

Tangible personal property purchased by a person who is licensed to operate a commercial radio or television station in Wisconsin, if the property is used exclusively and directly in the origination or integration of various sources of program material for commercial radio or television transmissions that are generally available to the public free of charge without a subscription or service agreement.

Fuel and electricity consumed in the origination or integration of various sources of program material for commercial radio or television transmissions that are generally available to the public free of charge without a subscription or service agreement.

Percent of fuel exempt: |

|

% |

Percent of electricity exempt: |

|

% |

Tangible personal property, property, items and goods under s.77.52(1)(b), (c), and (d), or services purchased by a Native American

with enrollment #, who is enrolled with and resides on the Reservation, where buyer will take possession of such property, items, goods, or services.

Tangible personal property and items and property under s.77.52(1)(b) and (c) becoming a component of an industrial or municipal waste treatment facility, including replacement parts, chemicals, and supplies used or consumed in operating the facility. Caution: Do not check the “continuous” box at the top of page 1.

Portion of the amount of electricity or natural gas used or consumed in an industrial waste treatment facility.

(Percent of electricity or natural gas exempt %)

Electricity, natural gas, fuel oil, propane, coal, steam, corn, and wood (including wood pellets which are 100% wood) used for fuel

for residential or farm use. |

% of Electricity |

% of Natural Gas |

% of Fuel |

|

|

Exempt |

|

Exempt |

Exempt |

Residential |

. |

|

% |

|

|

% |

|

% |

Farm |

|

% |

% |

% |

Address Delivered: |

|

|

|

|

|

|

|

|

Percent of printed advertising material solely for out-of-state use.

Catalogs, and the envelopes in which the catalogs are mailed, that are designed to advertise and promote the sale of merchandise or to advertise the services of individual business firms.

Computers and servers used primarily to store copies of the product that are sent to a digital printer, a plate-making machine, or a printing press or are used primarily in prepress or postpress activities, by persons whose NAICS code is 323111, 323117, or 323120.

Purchases from out-of-state sellers of tangible personal property that are temporarily stored, remain idle, and not used in this state and that are then delivered and used solely outside this state, by persons whose NAICS code is 323111, 323117, or 323120.

Other purchases exempted by law. (State items and exemption).