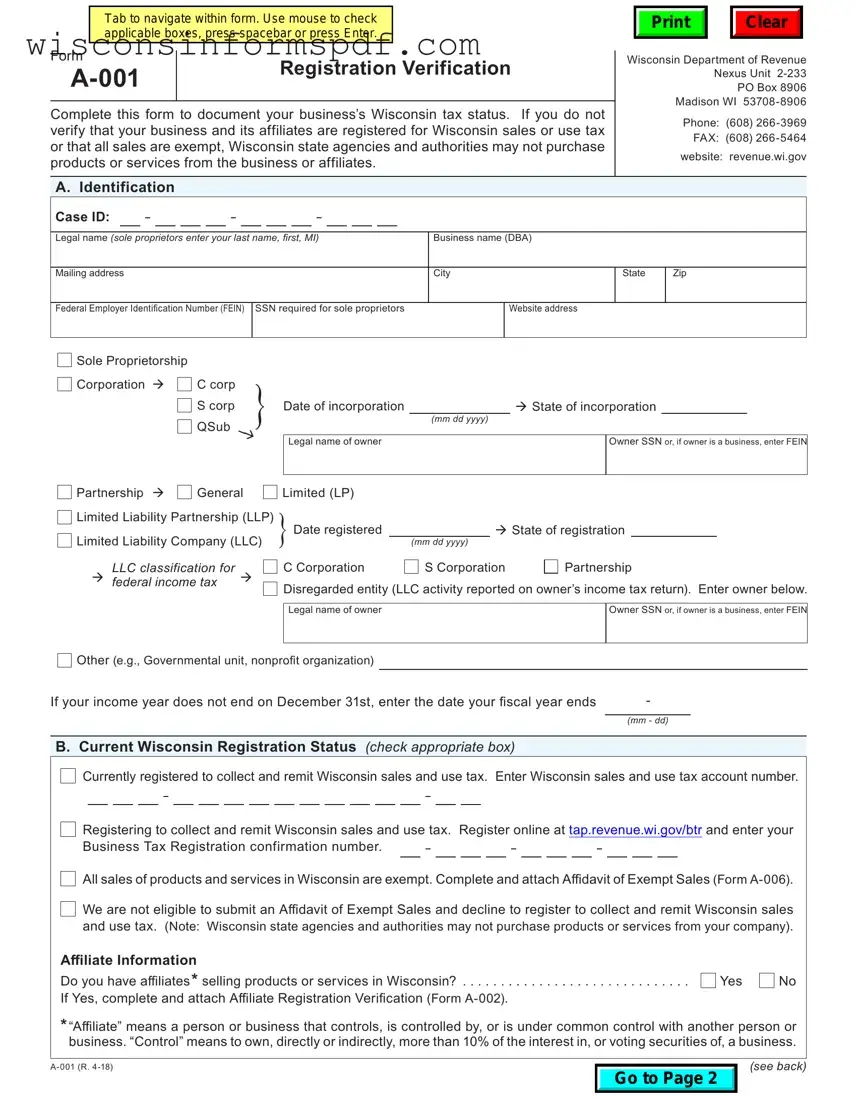

What is the purpose of the Wisconsin Verification form?

This form is used to document a business's tax status related to Wisconsin sales or use tax. It is a necessary step to verify that a business and its affiliates are properly registered to collect and remit Wisconsin sales or use tax, or that all their sales in Wisconsin are exempt from these taxes. This verification must be in place for Wisconsin state agencies and authorities to be able to purchase products or services from the business or its affiliates.

How can I submit the Wisconsin Verification form?

The form can be completed and sent to the Department of Revenue's Nexus Unit at the mailing address provided. While the form cannot be submitted online through an electronic submission system, you can visit the website for more guidance and information on the submission process. Additionally, registration for Wisconsin sales and use tax can be done online, and confirmation of this registration should be included if applicable.

What information is required to complete the form?

Completing the form requires various details about the business, including its legal name, business name (if applicable), mailing address, Federal Employer Identification Number (FEIN), state and date of incorporation or registration, and the type of business entity. For sole proprietors, a Social Security Number (SSN) is required. The form also asks for the business owner's legal name and SSN or FEIN, depending on the nature of the ownership. Additionally, details regarding the business's current registration status for Wisconsin sales and use tax, affiliate information, and specifics about the products and services offered in Wisconsin are necessary.

Who needs to complete the Affiliate Registration Verification (Form A‑002)?

If your business has affiliates that sell products or services in Wisconsin, then you must complete and attach the Affiliate Registration Verification (Form A‑002) in addition to the Wisconsin Verification form. An "affiliate" is defined as a person or business that controls, is controlled by, or is under common control with another person or business, where "control" means ownership of more than 10% of the interest in or voting securities of a business.

What happens if my business is not registered to collect and remit Wisconsin sales and use tax?

Wisconsin state agencies and authorities are prohibited from purchasing products or services from businesses that are not registered to collect and remit Wisconsin sales and use tax, unless all sales in Wisconsin are exempt. In cases where a business does not register and does not qualify for exemptions, it will be ineligible to conduct transactions with state agencies and authorities.

How do I determine if all sales in Wisconsin are exempt?

To verify that all sales in Wisconsin are exempt, businesses must complete and attach an Affidavit of Exempt Sales (Form A‑006). Exemptions might be applicable for various reasons, including sales to governmental units, sales for resale, non-taxable services, or other specific reasons that render the sales not subject to sales and use tax. Proper documentation or exemption certificates must be provided as proof of exempt status.

What should I do if my business's income year does not end on December 31st?

On the form, there is a section that allows businesses to specify if their fiscal year ends on a date other than December 31st. If this is the case for your business, you should enter the actual date your fiscal year ends in the space provided to ensure that all information is accurately reflected and in line with your business's financial reporting period.

Can I use this form to register for Wisconsin sales and use tax?

While the Wisconsin Verification form itself is not a registration document, it provides space to indicate your current registration status. If you are not yet registered but need to be, you can register online at the Department of Revenue's website and enter your Business Tax Registration confirmation number on the form. This step is crucial for businesses that need to start collecting and remitting Wisconsin sales and use tax.

Currently registered to collect and remit Wisconsin sales and use tax. Enter Wisconsin sales and use tax account number.

Currently registered to collect and remit Wisconsin sales and use tax. Enter Wisconsin sales and use tax account number.

Registering to collect and remit Wisconsin sales and use tax. Register online at

Registering to collect and remit Wisconsin sales and use tax. Register online at

All sales of products and services in Wisconsin are exempt. Complete and attach Affidavit of Exempt Sales

All sales of products and services in Wisconsin are exempt. Complete and attach Affidavit of Exempt Sales

Sales to governmental units

Sales to governmental units

Sales for resale

Sales for resale

Sales are not taxable. Exemption certificates provided by customers or nontaxable services

Sales are not taxable. Exemption certificates provided by customers or nontaxable services