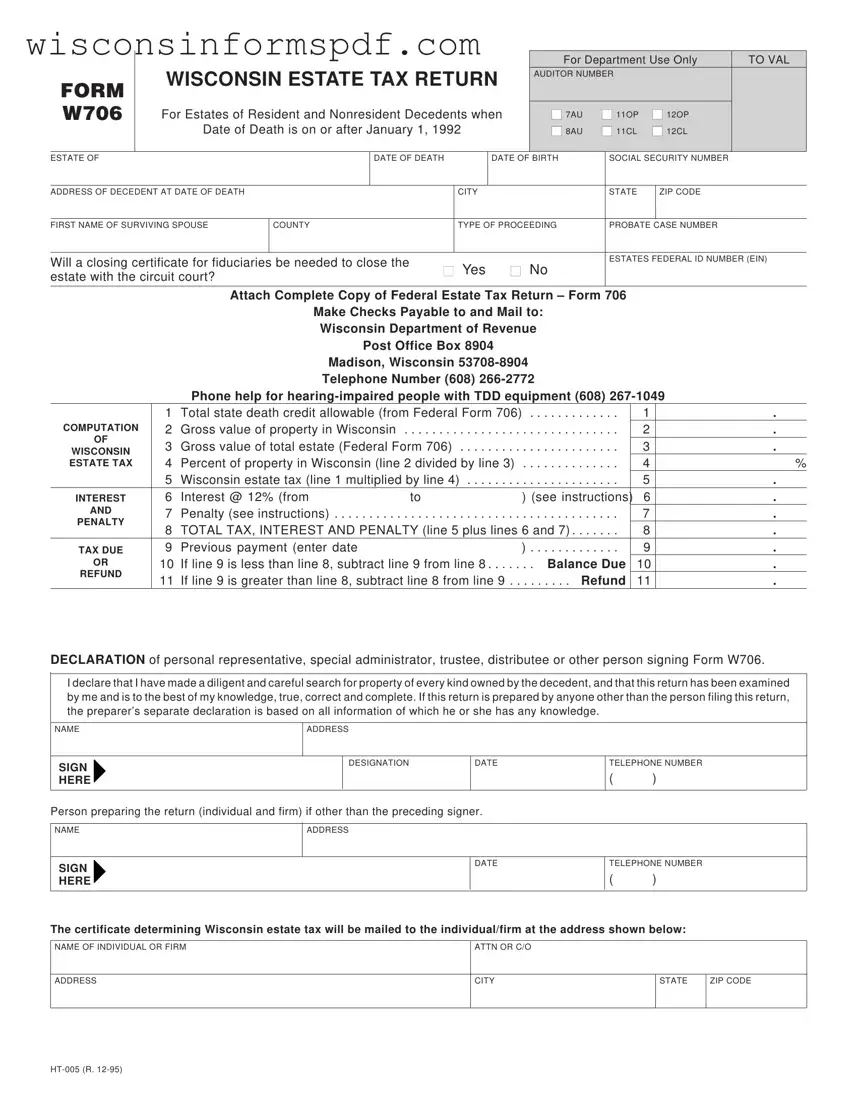

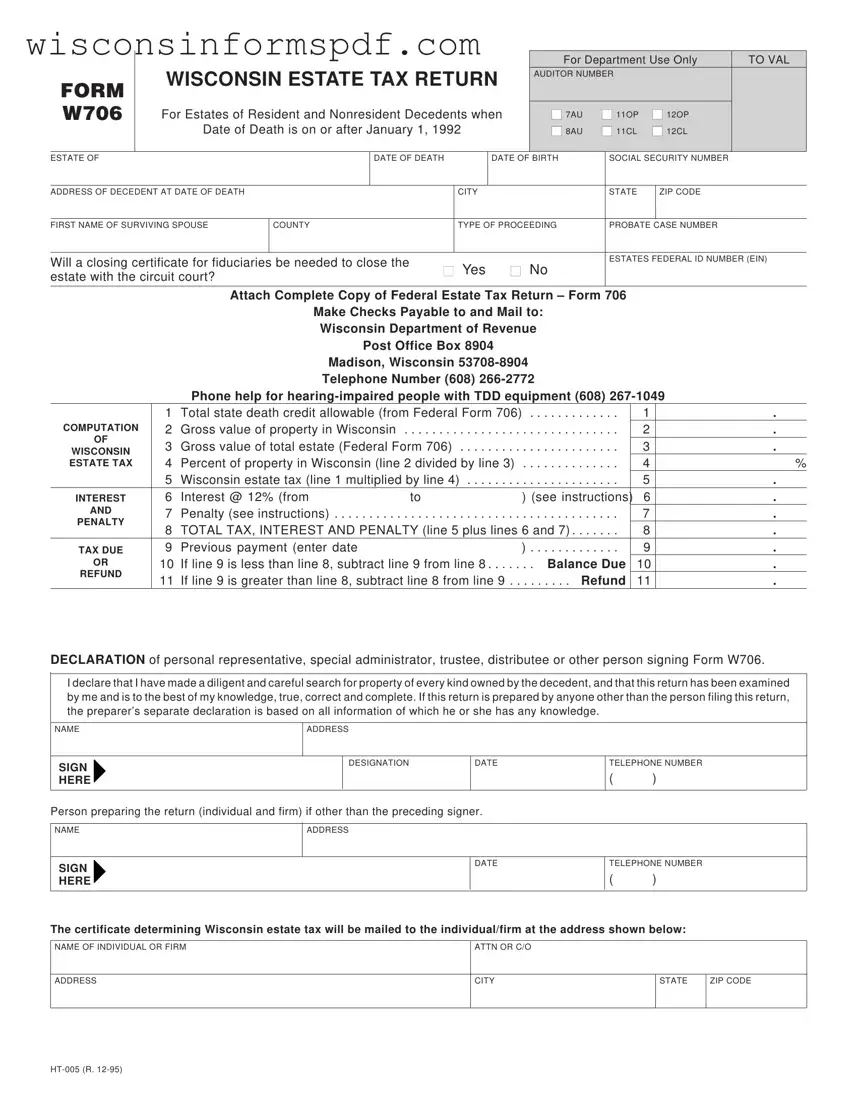

When approaching the topic of estate planning and tax obligations in Wisconsin, there’s often a cloud of misconceptions surrounding the W706 form. Understanding the common misunderstandings can provide clarity for individuals navigating through these sometimes challenging waters.

Misconception #1: The W706 form is only for residents of Wisconsin.

While the form is primarily designed for estates of Wisconsin residents, it's equally pertinent for nonresidents who own property within the state. The requirement hinges not on residency but on whether the decedent owned property in Wisconsin, thus potentially owing estate taxes to the state.

Misconception #2: All estates must file Form W706 regardless of their size.

The necessity to file the W706 is not universal for all estates. It's contingent upon the gross value of the decedent’s estate, including property located within Wisconsin, surpassing certain thresholds that necessitate filing a federal estate tax return.

Misconception #3: Form W706 is the only document needed for estate tax purposes.

Completing Form W706 is just one step in the process. The form explicitly instructs the estate's representative to attach a complete copy of the federal estate tax return (Form 706). This implies the interdependence of state and federal estate tax filings.

Misconception #4: The Wisconsin Estate Tax can simply be estimated.

The calculation of the Wisconsin estate tax is not straightforward and cannot be merely estimated. It requires precise computations based on the allowable state death credit from the federal estate tax form and the proportional value of the estate's property located in Wisconsin.

Misconception #5: A closing certificate for fiduciaries is optional.

This document is crucial for legally closing the estate in the eyes of the court. The query regarding its necessity is not a matter of option but a step that clarifies whether this legal document, confirming tax obligations have been met, is needed to finalize the estate's closing.

Misconception #6: The declaration section is a formality without legal bearing.

The declaration made by the personal representative or other signing party is a legally binding assertion. It confirms that a diligent search for the decedent's property was conducted and that the information provided is accurate to the best of their knowledge, with significant legal implications for inaccuracies.

Misconception #7: Interest and penalties are rare.

Interest and penalties can and will be applied if taxes are overdue or filings are late. The rate and conditions under which they apply are explicitly stated, underscoring the importance of timely and accurate submissions.

Misconception #8: Previous payments are automatically deducted from the total tax obligation.

Calculating the balance due or refund involves explicitly acknowledging previous payments. This step is not automatic; it requires accurate documentation and calculation to ensure the estate’s tax obligation reflects these payments.

Misconception #9: The mailing address for the W706 is insignificant.

The address provided not only directs where the completed form and accompanying payment or correspondence should be sent, it also serves as the destination for the certificate determining Wisconsin estate tax. Accuracy in this detail is crucial for ensuring that all pertinent documents reach their intended recipients without delay.

HERE

HERE HERE

HERE