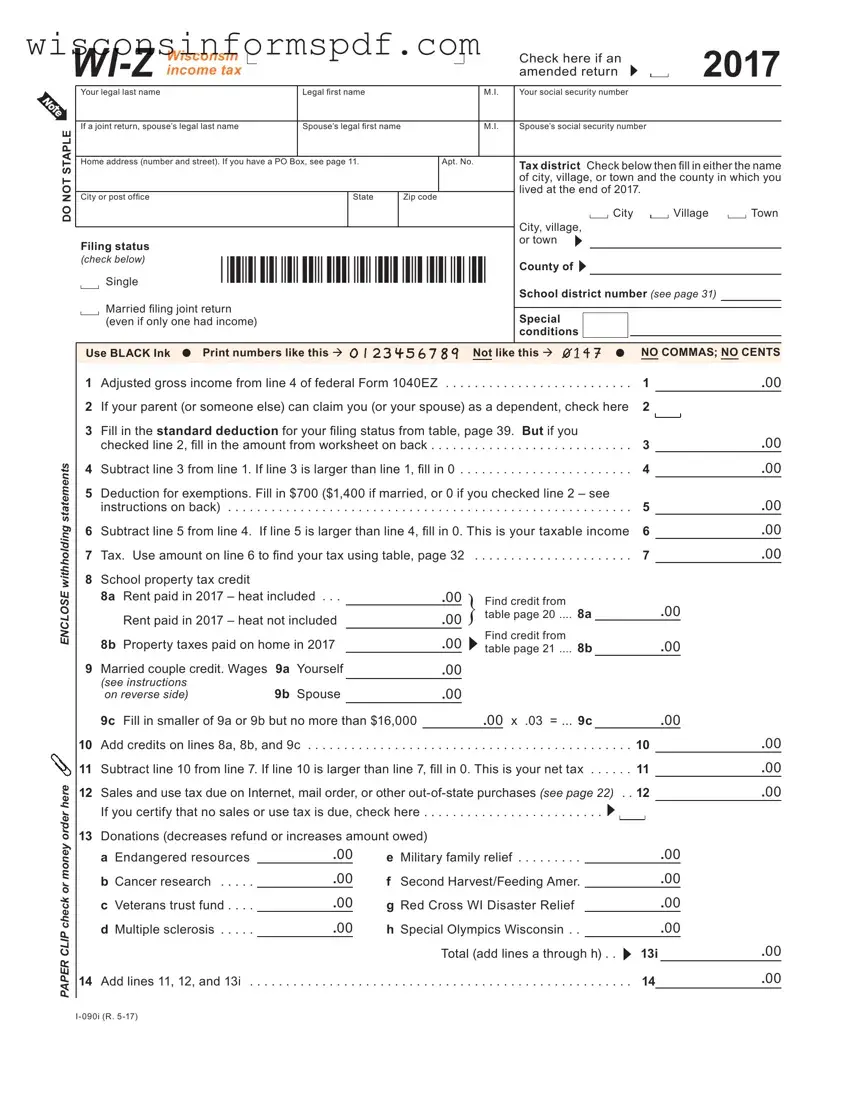

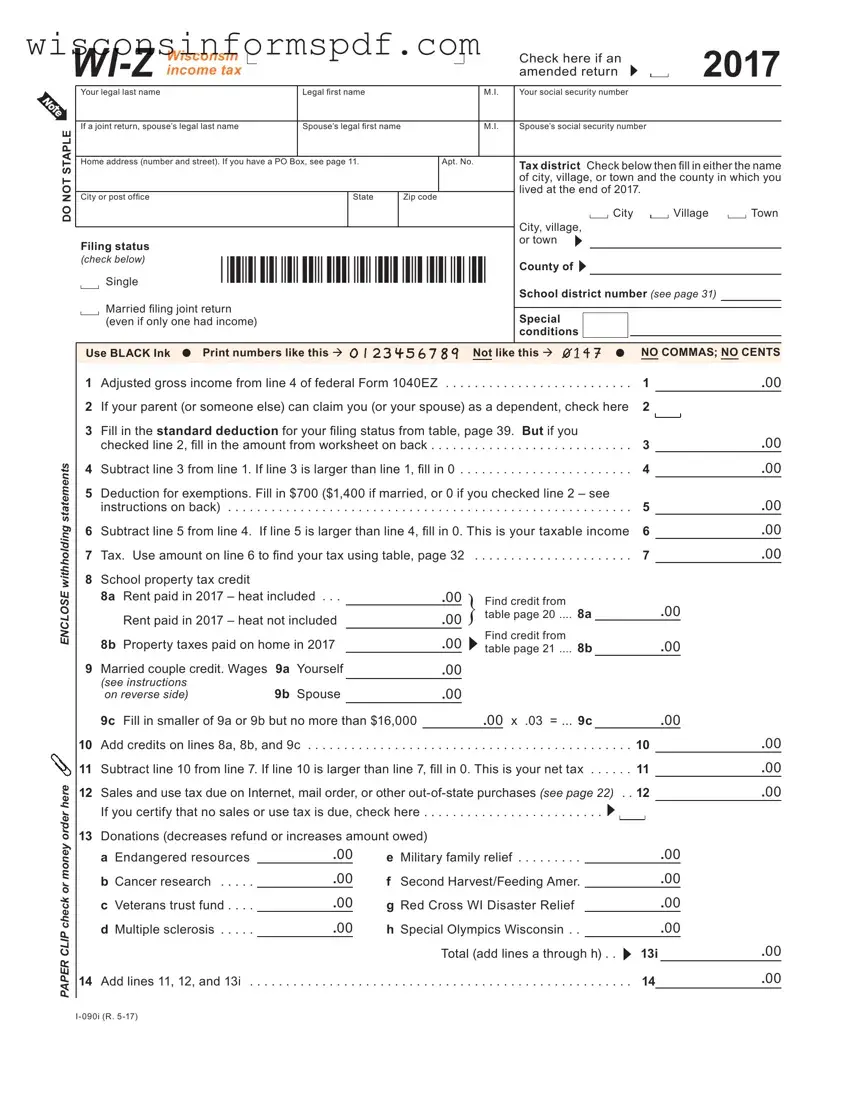

What is the WI-Z form?

The WI-Z form is a document specifically designed for Wisconsin residents to file their state income tax returns. It is intended for individuals with simpler tax situations, such as having income exclusively from wages, salaries, tips, unemployment compensation, and interest of $1,500 or less. If eligible, taxpayers can use this form to report their income and calculate their taxes or refund due for the year 2017.

Who is eligible to file a WI-Z form?

Eligibility for using the WI-Z form primarily depends on the simplicity of the taxpayer's income sources and amounts. Generally, individuals who have only earned income (wages, salaries, and tips) and possibly unemployment compensation, along with interest income of not more than $1,500, can use this form. Additionally, it is important that the taxpayer does not claim any adjustments to income other than the standard deduction.

Can I file an amended return using the WI-Z form?

Yes, if after filing your original return you need to make changes, the WI-Z form allows for the submission of an amended return. To do this, simply check the box marked "amended return" at the top of the form. Remember to include all necessary adjustments and attach any required documentation or schedules to support your changes.

What is the standard deduction, and how do I calculate it?

The standard deduction is a set amount the IRS allows taxpayers to deduct from their gross income to reduce their taxable income, thereby potentially lowering the amount of tax owed. The exact amount of your standard deduction on the WI-Z form varies depending upon your filing status, and additional instructions are provided for those who can be claimed as dependants on someone else's return. Specific amounts and conditions are detailed in the form's instructions and accompanying tables.

How do I report a school property tax credit?

The school property tax credit is available for Wisconsin taxpayers and is reported on lines 8a and 8b of the WI-Z form. To claim this credit, you'll need to detail either the rent paid where heat is included, rent paid where heat is not included, or property taxes paid on your home during the year. Maximum credit amounts and additional details are specified within the form's instructions.

What is the Married Couple Credit and how do we qualify?

The Married Couple Credit provides tax relief to married couples where both spouses have earned income during the tax year. To qualify, both you and your spouse must have reported wages, and the credit is calculated by comparing the incomes, ensuring neither surpasses $16,000 for eligibility. The specific calculation method is outlined on the form, involving a percentage of the smaller wage amount up to a capped benefit.

What if I didn't pay sales and use tax on out-of-state purchases?

If during the tax year you made purchases from out-of-state businesses and didn't pay Wisconsin sales tax at the time of purchase, you might owe use tax on those items. Line 12 of the WI-Z form is designated for reporting this tax. Details on how to calculate and report this, including a check box to certify if no sales or use tax is due, are provided in the form's instructions.

Can I make donations through my WI-Z tax return?

Yes, the WI-Z form allows taxpayers to contribute to various state-supported funds and programs directly through their tax return. Lines 13a through 13h list specific donation options, such as endangered resources, cancer research, and veterans' trust fund, among others. Any amounts you donate will either reduce your refund or add to the tax owed. Ensure to fill in the total donation on line 13i.

How do I submit the WI-Z form, and what documents should accompany it?

After completing the WI-Z form, mail your return to the address provided on the form itself, which varies depending on whether you are due a refund or owe tax. Be sure to sign your return; if filing jointly, your spouse must sign too. Attach a copy of your W-2 forms to report Wisconsin income tax withheld. For an amended return, also include Schedule AR and any other relevant supporting documentation. Do not staple any documents to the form; use a paper clip instead.