|

Section F – License Plate Types |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

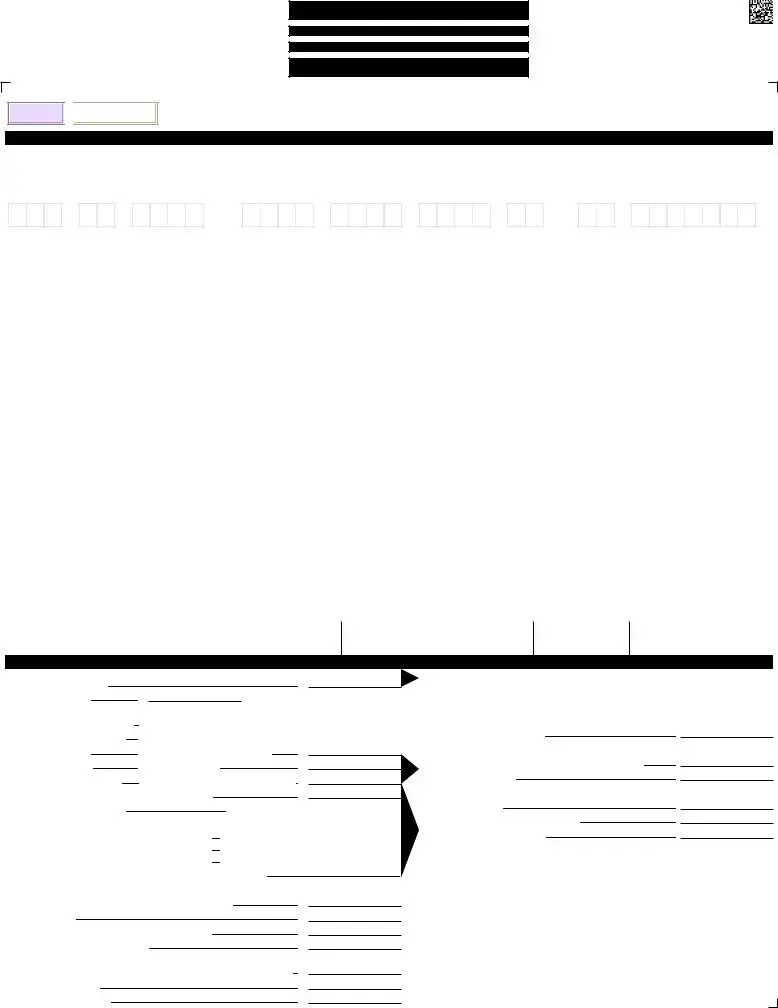

Vehicle type and use determines the vehicle registration. Fees shown are annual unless otherwise indicated. |

|

|

|

|

|

|

VEHICLE will be used “For Hire” |

|

|

|

|

|

AUT* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Authority Number: |

|

|

|

Automobile |

Passenger Vehicle/Auto Fee = $85. Check if |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TMP |

Intransit/Temporary Operation 30/90 day plate to operate a vehicle except buses, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For Hire or IRP vehicles. Fee = $3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MOTORCYCLE/MOPED |

|

|

|

Motorcycle |

CYC* |

Motorcycle of less than 1,500 lbs. two-year registration only. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

manufactured for highway use |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and displays required Federal |

|

|

|

|

|

|

|

|

|

Plates expire in April of even numbered years. Fee = $23 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Certification Label. |

|

|

|

|

|

|

|

MPD |

Moped (a maximum speed of 30 mph, 50 cc or less if automatic transmission, 130 cc or less if |

|

|

|

|

|

|

NOTE: If this box is not checked, the |

|

|

|

|

|

|

|

|

|

operative pedals) Two-year registration only - plates expire in April of even numbered years. Fee = $23 |

|

entire application will be returned. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Recreation |

MTM* |

Motor Home used as temporary or recreational dwelling. Fee = Column “H” of fee schedule. |

|

|

|

|

|

|

RV TRAILER LENGTH: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RVT |

RV Trailer (walls rigid, collapsible or non-collapsible - for human habitation.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Show length at right. Fee = $15 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MOTOR CARRIER CLASS |

|

|

|

|

|

|

|

FRM* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Include $5 permit fee if operating vehicle |

|

|

Farm |

Farm Truck used primarily for transporting my farm produce and supplies and NOT for traveling to |

|

|

|

|

|

|

ONLY in Wisconsin. No permit fee is |

|

|

|

|

|

|

|

|

|

and from a non-farm occupation (if 38,000 pounds or more, truck must be used EXCLUSIVELY for |

|

|

|

|

|

|

required for semi-trailers. |

|

|

|

|

|

|

|

|

|

|

|

transporting farm produce and supplies.) Fee = Column “E” of fee schedule. |

|

|

|

|

|

|

Check one: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Private - No permit fees (1) |

|

|

|

|

|

|

|

|

|

|

Farm Truck Tractor used EXCLUSIVELY for transporting supplies, farm equipment and products. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rental - Private (5) |

|

|

|

|

|

|

|

|

|

|

|

Annual Fee = Column “J” of fee schedule. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rental - For Hire ... $5 (6) |

|

|

|

|

|

|

|

DPF* |

Dual Purpose Farm (Farm and non-farm activity) register at gross wt. when used for non-farm occupation. |

|

Rental - Private & For Hire ... $5 (7) |

|

|

|

|

|

|

|

|

|

Farm activity, maximum gross wt. is 12,000 lbs. Fee = Column “A” of fee schedule. |

|

|

|

|

|

|

Intrastate (operate inside Wisconsin |

|

|

|

|

|

FTL |

Farm Trailer used exclusively for farm purposes. Fee = Column “F” of fee schedule. |

|

|

|

|

|

|

only) For Hire, PC or LC ... $5 (8) |

|

|

|

|

|

|

|

|

|

|

|

Interstate (operate outside Wisconsin) |

|

|

|

|

|

HTK |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For Hire (9) |

|

|

|

|

Truck |

Truck operated at 8,000 lbs. or more privately or under authority. |

|

|

Fee = Column “A” of fee schedule. |

|

Interstate - Exempt For Hire (3) |

|

|

and/or |

LTK* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interstate - Exempt/Intrastate For Hire (4) |

|

|

Truck operated at 8,000 lbs. or less privately or under authority. |

|

|

Check Consecutive Monthly |

|

|

|

|

|

|

NOTE: All For Hire Carriers must show |

|

|

Tractor |

DPV* |

Dual Purpose Truck changes between a truck and motor home. |

} Registration block if applicable |

|

Authority Number(s) (LC, MC, PC, RC) |

|

|

|

|

|

DAIRY |

|

(Registered at gross wt. when used as a truck) |

|

|

|

|

|

|

} |

|

Fee = Column “C” of fee schedule if |

|

Authority Number(s): |

|

|

|

|

|

|

|

Motor vehicle transporting Dairy Products EXCLUSIVELY. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WOOD |

Vehicle transporting Raw Forest Products EXCLUSIVELY. |

|

|

|

|

truck-tractor, “D” if truck, “F” if trailer. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Must qualify by Wisconsin Statute |

|

|

|

|

|

|

|

|

|

|

|

|

TOR |

Truck Tractor normally used with semi-trailer. Fee = Column “B” of fee schedule, or if used as road tractor, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

column “A” of fee schedule. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trailer |

SEMI |

Semitrailer used with a Truck Tractor. Fee = $50. for non-expiring, not transferable plates |

|

|

|

|

|

|

Apply for a US DOT Number: |

|

|

|

|

|

|

|

|

|

|

Phone: 1-800-832-5660 |

|

|

|

|

|

|

|

TRL |

Trailer registration is optional for private operation 3,000 lbs. or less. Fee = $50.00. |

|

|

|

|

|

|

Internet: www.safer.fmcsa.dot.gov |

|

|

|

|

|

|

|

|

|

|

If over 3,000 lbs., registration required. Fee = Column “G” of fee schedule. Trailer for rental or For Hire |

|

CONSECUTIVE MONTHLY REGISTRATION |

|

|

|

|

|

|

|

|

|

must be registered. Check Consecutive Monthly Registration block if applicable |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Used exclusively for one of the following: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bus |

BUS |

Bus capacity = 16 or more persons. Fee = Column “A” of fee schedule |

|

|

|

|

|

|

|

|

|

|

|

|

|

• To transport concrete pipe or block and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

related materials; calcium chloride liquid; |

|

|

|

|

|

BBX |

Urban Mass Transportation Bus Fee = $5. (5 year plate) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

recycled metal salvage materials; logs or |

|

|

|

|

|

BSB |

School Bus Fee = $5. (5 year plate) Pre-sale inspection required |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

pulpwood; dirt, fill or aggregates; fresh |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

milk; perishable fresh fruits or vegetables |

|

|

GOV |

Official (Star) Municipal (Tan) State Owned (Red) |

|

|

|

|

|

|

|

|

|

|

Fee of $5 for new plate |

|

for canning, freezing, dehydrating or |

|

|

|

|

|

|

|

|

|

|

|

|

|

storage prior to processing, including |

|

|

Plates |

Unmarked (choose one): Auto Light Truck: Weight |

|

|

|

|

|

lbs. Cycle } issued, $1 for plate transfer. |

|

return of waste; petroleum products; or as |

|

|

|

|

|

|

|

|

a weight transfer machine for purposes |

|

|

|

|

|

|

|

|

|

|

|

Special |

HSV |

Human Service Vehicle Fee = $85. Funded by WisDOT transportation assistance |

|

|

|

|

|

|

associated with truck or tractor pulling |

|

|

|

|

|

|

|

competitions or events. |

|

|

|

|

Use |

DEV* |

Driver Education Vehicle Fee = $5. (5 year plate) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• To transport gravel, concrete or cement |

|

|

|

|

|

SPZ |

Vehicle owned privately and used exclusively for one of the following. Fee = Column “F” of fee schedule. |

|

and bituminous road construction |

|

|

|

|

|

|

|

|

materials; or agricultural lime, feed, grain |

|

|

|

|

|

|

|

|

|

Seasonal hauling of carnival rides & equipment |

Transporting grading, ditching, or excavating equipment |

|

or fertilizer. |

|

|

|

|

|

|

|

|

|

SUX |

Special Mobile Equipment – refer to form MV2953 for more information. |

|

|

|

|

|

|

|

|

|

|

|

|

|

• As a Motor Truck or Truck-Tractor |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

owned or leased by a retail lumberyard |

|

|

|

|

|

SPX |

Vehicle owned, operated and used exclusively for one of the following. Fee = $5. (5 yr. plate) |

|

|

|

|

|

|

used exclusively to transport building |

|

|

|

|

|

|

|

|

|

Motor Bus for charitable purposes Motor Bus for parade participants Other qualifying vehicles |

|

construction materials from retail |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

lumberyards to building construction sites. |

|

Special |

A full listing of special plates and applications is available at wisconsindmv.gov/specialplates. |

|

|

|

|

|

|

• To tow stalled or disabled vehicles. |

|

|

Plates |

OTHER |

Special Plate (Other) - Attach Application |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PASSENGER CAPACITY |

|

|

|

Autocycle |

ACY |

Autocycle fee = $45.00, MAY-APR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bus |

|

School Bus |

|

HSV |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Use form MV16 for Autocycle Registration Fee Schedule |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

School Bus |

approved for |

registration: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Section G – MAILED APPLICATIONS ONLY – eNotify Electronic Renewal Notification wisconsindmv.gov/enotify |

|

X |

|

|

|

|

|

Sign up to receive your renewal notices electronically! Instructions will be emailed to the address below: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Signature) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Badge Number) |

(Date) |

|

|

Section H – Consent to Purchase |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

UNDER 18 |

I certify that I have legal custody of the person named as owner and |

|

|

Date Signed |

Signature (legal custodian, parent or guardian) |

|

consent to the purchase by such person and registration of the vehicle |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YEARS OLD |

|

|

|

|

|

|

|

|

|

|

|

|

X |

|

|

|

|

|

|

|

|

described in the applicant’s name. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NOTARY |

County |

|

|

|

|

Date my commission expires |

|

Date subscribed and sworn to before me |

Notary Signature |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PUBLIC |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

X |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I (we) certify that the information and statements on this application are true and correct. Commercial Carrier: I further certify that I have knowledge of applicable federal and state motor carrier safety rules, regulations, standards, and orders, and declare that all operations will be conducted in compliance with such requirements.

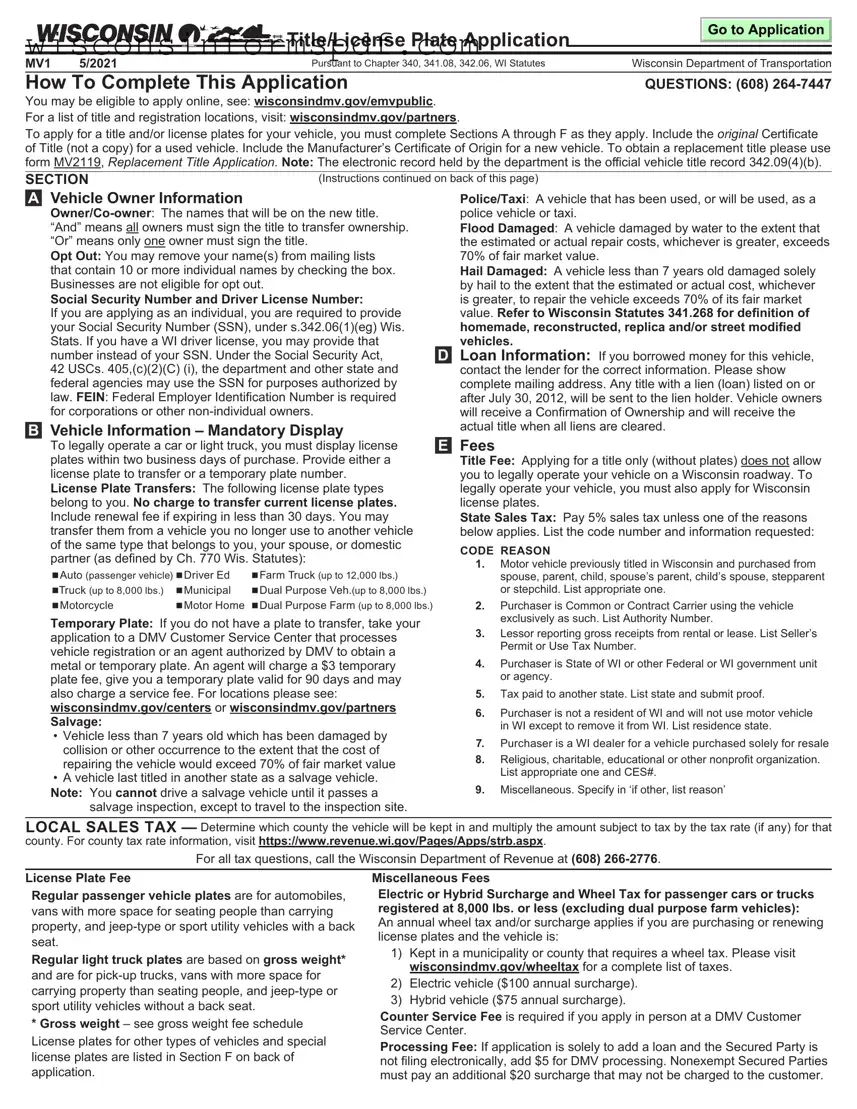

Title/License Plate Application

Title/License Plate Application

Instructions

Instructions