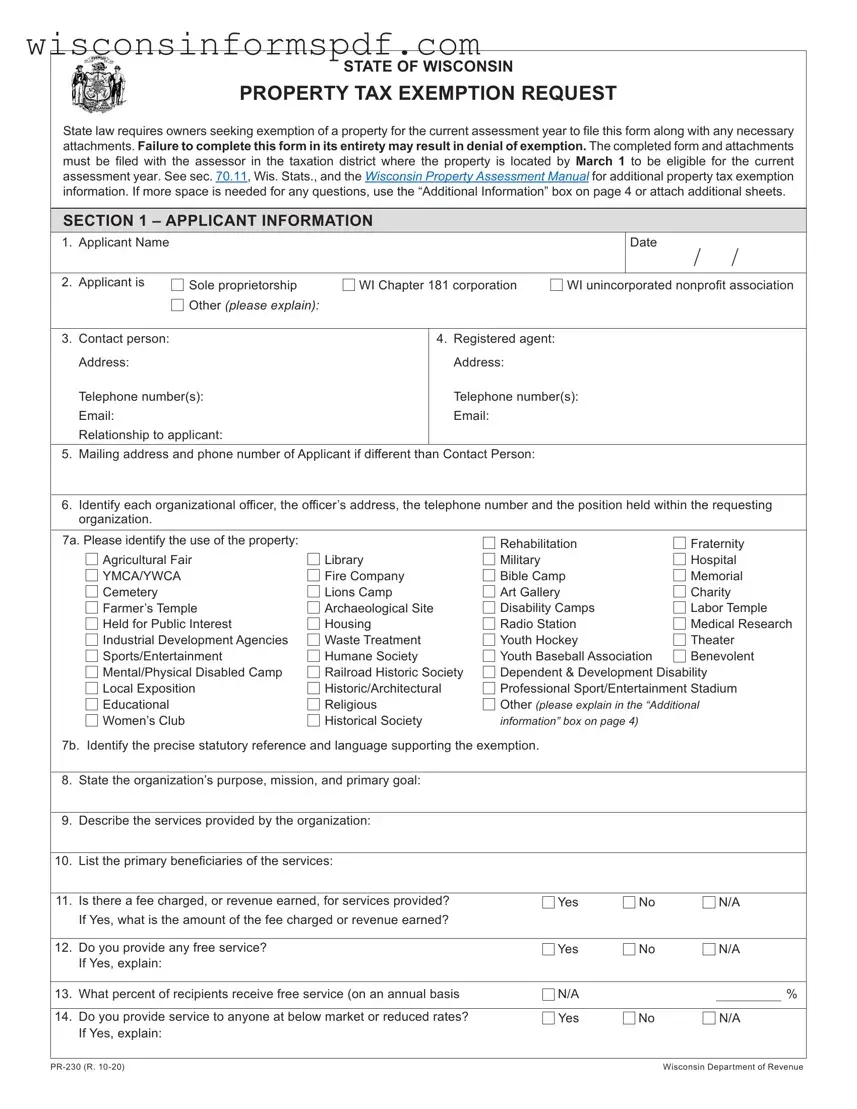

The Wisconsin PR-230 form, used for property tax exemption requests, has aspects in common with other documents vital for managing and certifying the status of various entities and properties. One similar form is the IRS Form 1023, which organizations use to apply for recognition of exemption under Section 501(c)(3) of the Internal Revenue Code. Both forms require detailed information about the organization's purpose, activities, and financials, aiming to establish eligibility for tax-exempt status.

Equally, the Form 990, an annual return that tax-exempt organizations must file with the IRS, shares a resemblance. This document, like the Wisconsin PR-230, collects detailed financial data, operational information, and governance structure to maintain compliance with tax-exempt regulations. Both serve as transparency tools, providing the necessary oversight agencies and the public with insights into an organization's operations and financial status.

The Uniform Commercial Code (UCC-1) financing statement is another document with similarities. While its primary purpose is to secure interest in a debtor's personal property to ensure payment of a debt, it requires detailed information about the parties involved and the collateral, akin to how the PR-230 form identifies relationships and use of property in tax exemption contexts.

The Certificate of Zoning Compliance, often used in various municipalities across the United States, also parallels the Wisconsin PR-230 form. It confirms a property's compliance with local zoning ordinances, including its allowed uses, much like how the PR-230 form requires detailed explanations of property use to qualify for tax exemption.

Articles of Incorporation, filed by entities to legally establish a corporation, share commonalities with the PR-230 form. Both require comprehensive organization details, such as names and addresses of key individuals, organization purposes, and operational specifics to fulfill statutory requirements for recognition and benefits under the law.

The Grant Deed, a document that transfers ownership of real property, bears a resemblance to the PR-230 in that it must describe the property in detail, including its legal description and parcel number. Similarly, the PR-230 requires precise information about the property seeking tax exemption, ensuring clear identification and eligibility assessment.

The Application for Building Permit is another similar document. It necessitates a thorough description of property use, a legal description, and detailed plans for the intended development or use of the property. This mirrors the requirement on the PR-230 form to detail how the nonprofit organization uses the property in question.

A Certificate of Occupancy, issued by local government agencies to confirm a building's compliance with building codes and its suitability for occupancy, also aligns with the PR-230 form in its function. Both ensure that the use of a property adheres to specific standards and regulations before granting approval for its intended use.

The Environmental Impact Assessment (EIA) report also shares similarities. Though its primary focus is on assessing the environmental effects of proposed projects, it requires a comprehensive analysis of how a project uses land, which parallels the detailed property use information and justification needed for the PR-230 form.

Finally, the Declaration of Covenants, Conditions, and Restrictions (CC&Rs) in real estate developments resemble the PR-230 form. CC&Rs outline the rules and guidelines for properties within a community, including acceptable use of property. The PR-230 form similarly requires detailed descriptions of property use to establish eligibility for tax exemption based on those activities.