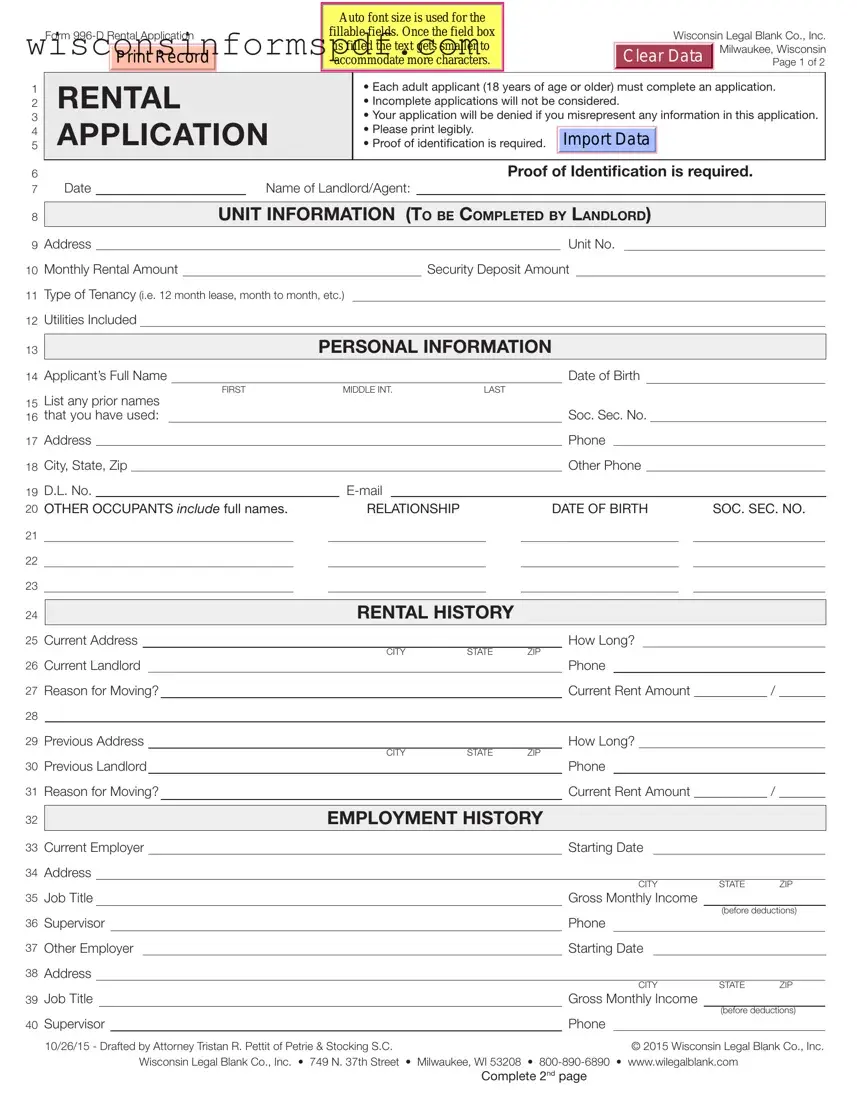

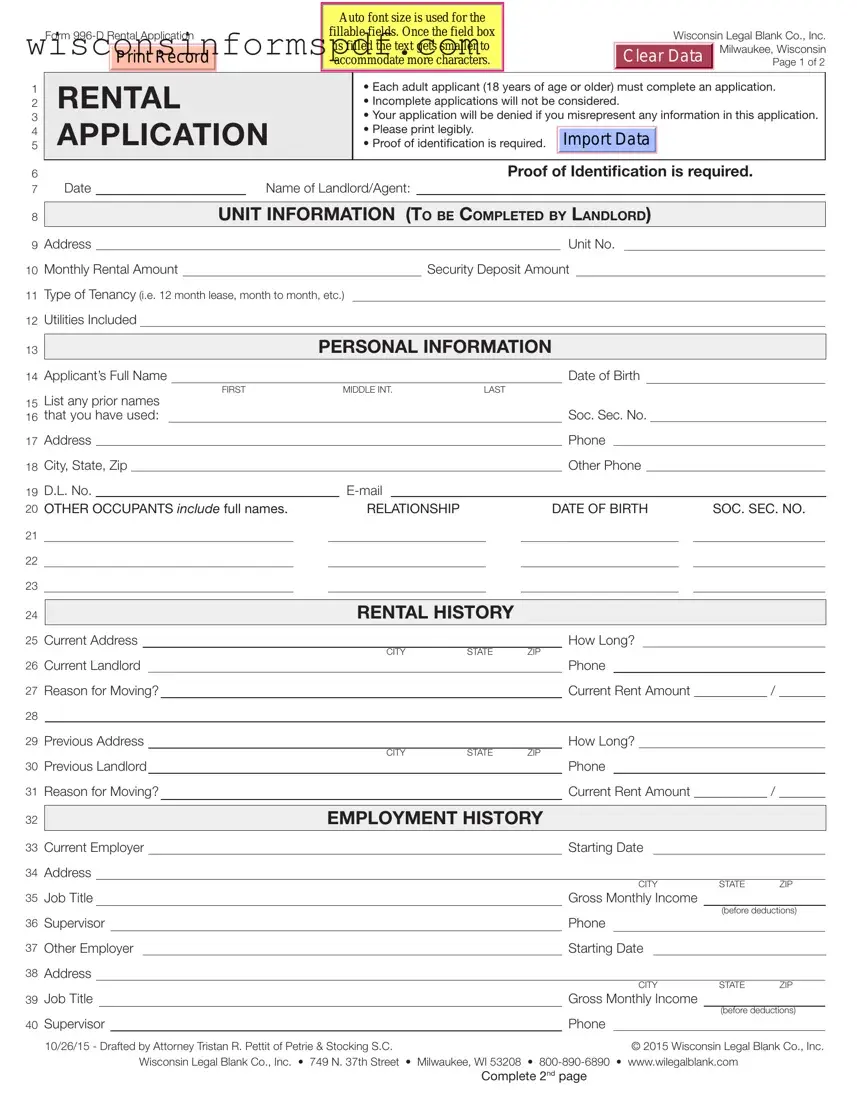

The Wisconsin Rental Application form shares commonalities with an Employment Application form, as both require personal information, employment history, and references to evaluate the applicant's qualifications and reliability. Just as a rental application assesses potential tenants' ability to meet monthly payments and care for the property, an employment application helps employers determine an applicant's suitability for a position based on their work history and skills.

Similarly, a Loan Application form mirrors the financial aspect of the Rental Application by requiring detailed financial information, including income, bank accounts, and credit references. Both forms use this financial data to assess the applicant's financial stability and the ability to meet financial obligations, whether it's repaying a loan or paying rent on time.

A Credit Card Application also aligns with parts of the Rental Application, especially in sections regarding credit history and financial information. Credit card companies evaluate an applicant’s credit worthiness to predict the financial risk, similar to how landlords assess whether a potential tenant will reliably pay rent. Both applications may require information about income and existing debts to make this assessment.

The Wisconsin Rental Application form and a Tenant Screening Report share objectives in evaluating a person's background for eligibility and reliability, albeit for different purposes. Where the rental application gathers information directly from the applicant, a tenant screening report typically compiles data from various sources to provide landlords a comprehensive view of an applicant’s rental, financial, and criminal history.

A Mortgage Application parallels the Rental Application form in its requirement for detailed personal, financial, and employment information to assess the applicant's ability to take on a significant financial commitment. Both assess an individual’s financial health and stability to ensure they can uphold their payment obligations, whether towards monthly rent or a mortgage payment.

A Car Rental Agreement Application, while focused on the temporary use of a vehicle rather than housing, necessitates similar personal identification, financial information, and history to ensure the renter can and will comply with the terms of the rental agreement, including payments and care of the property.

An Auto Loan Application can also be seen as similar to the Rental Application form in the way it includes financial information, employment history, and credit references to evaluate an applicant's ability to afford regular payments. Both forms aim to mitigate financial risk by assessing the applicant's economic stability.

Similarly, a Scholarship Application, though primarily academic in focus, requires personal information, history, and references that are used to evaluate the applicant’s eligibility and merit. Much like a rental application examines the potential tenant's ability to meet financial and personal responsibility, a scholarship application assesses academic and sometimes financial qualification for an award.

Lastly, the similarities with a Lease Agreement are evident, as both the Rental Application and a Lease Agreement deal directly with housing arrangements. While the rental application is the initial step in assessing suitability for tenancy, the lease agreement is the formal arrangement that outlines the terms of this tenancy once the application is approved, encompassing many details first introduced in the application.