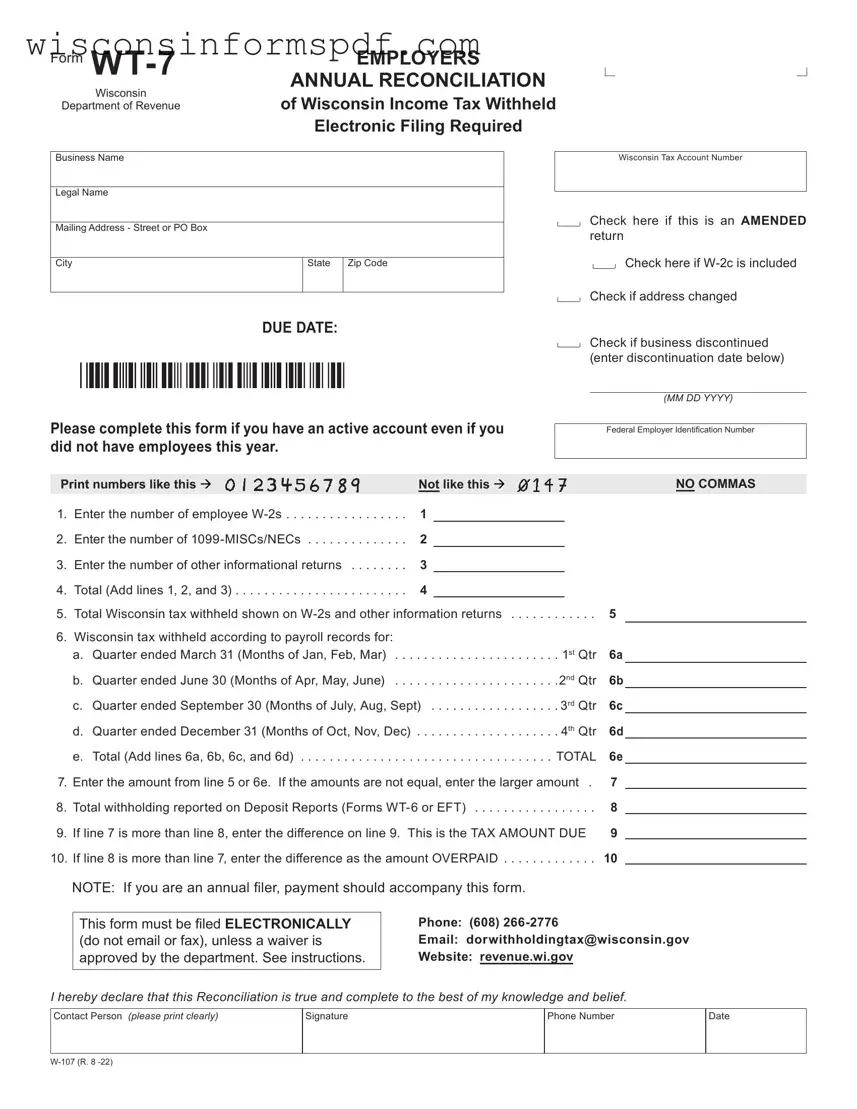

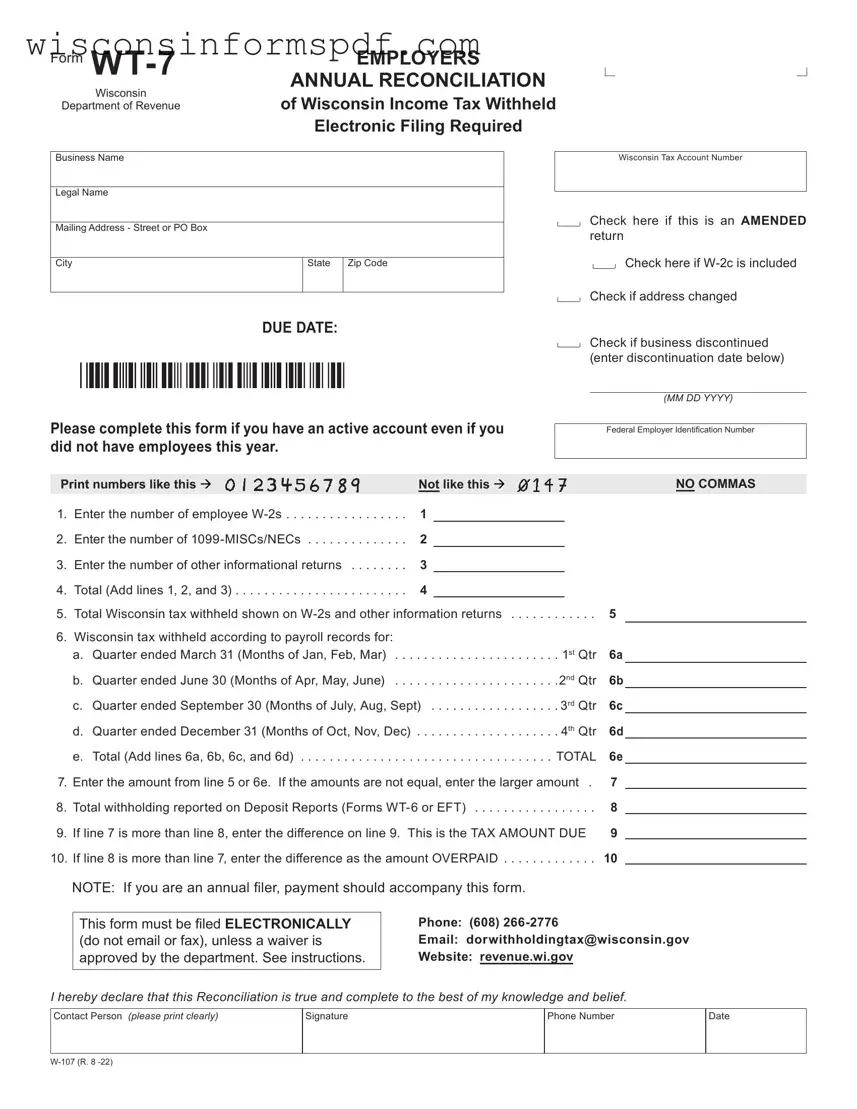

What is the Form WT-7 and who needs to file it?

The Form WT-7, also known as the Employers Annual Reconciliation of Wisconsin Income Tax Withheld, is a required form for employers in Wisconsin. It serves to reconcile the amount of state income tax withheld from employees' paychecks throughout the year. Employers who have withheld income tax from employees' wages or have issued W-2s, 1099-MISCs, or 1099-NECs with Wisconsin tax withheld must file this form.

What is the due date for filing Form WT-7?

The due date for filing Form WT-7 is January 31st of the year following the tax year being reported. For example, for the tax year 2021, the form must be submitted by January 31, 2022. It's essential to meet this deadline to avoid any penalties or interest for late filing.

Is electronic filing of Form WT-7 mandatory?

Yes, the Form WT-7 must be filed electronically with the Wisconsin Department of Revenue unless the employer has received a specific waiver that permits them to file by paper. This electronic filing requirement helps streamline the process and ensure accurate and timely submission.

What happens if I need to amend a Form WT-7 already filed?

If you discover an error on a previously filed Form WT-7, you are required to submit an amended return. To do this, check the box on the form indicating that it is an amended return. You'll need to provide updated information and correct any errors from the original submission.

What if I did not have employees this year? Do I still need to file Form WT-7?

Yes, if you have an active account with the Wisconsin Department of Revenue, you are required to file Form WT-7, even if you did not have employees or withhold any income tax during the year. This helps the department maintain accurate records and ensures compliance.

How do I know if I need to include a W-2c with Form WT-7?

If you need to correct any information after W-2 forms have been submitted to the state, a W-2c form must be completed and included with your Form WT-7. This includes any corrections to employees' income, tax withheld, or personal information.

What should I do if my business address or legal name has changed?

If there have been changes to your business address or legal name, you must indicate this on Form WT-7 by checking the appropriate box. This ensures that your business information is updated and that all correspondence from the Wisconsin Department of Revenue is sent to the correct address.

Can I file Form WT-7 if my business has been discontinued?

Yes, if your business has been discontinued, you should still file Form WT-7 for any year in which you had an active withholding account. It is crucial to include the discontinuation date on the form, which notifies the Wisconsin Department of Revenue that no future filings will be necessary under that account.